Published in Market Analysis

Meat in Europe: Fewer Animals, Bigger Pressure

Europe produces less meat than before, poultry keeps growing, pigmeat is unstable, and rules and costs are reshaping the entire meat industry.

Martina Osmak

Director of Marketing

The meat industry is getting smaller, not bigger

Across the European Union, livestock numbers are falling.

At the end of 2024, EU farms had:

132 million pigs

72 million bovine animals (mainly cattle)

67 million sheep and goats

Compared with 2009, the total number of these animals fell from 309 million to 271 million, a drop of 12.2%.

Goat numbers fell the most (–18.1%), while cattle declined more slowly (–10.0%).

This long-term decline means less raw material for slaughterhouses and processors, even before any policy or market effects are considered.

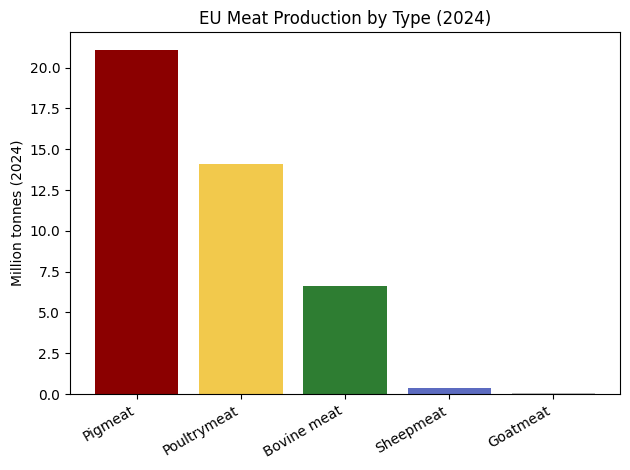

How much meat does the EU produce today?

In 2024, total EU meat production was dominated by pigmeat and poultry.

Production volumes in 2024:

Pigmeat: 21.1 million tonnes

Poultrymeat: 14.1 million tonnes

Bovine meat: 6.6 million tonnes

Sheepmeat: 0.37 million tonnes

Goatmeat: very small volumes

Pigmeat alone accounted for about 50% of all EU meat production.

Long-term trends: very different stories by meat type

Pigmeat

From 2009 to 2021, EU pigmeat production grew by 12.2%, even though pig numbers were falling.

After 2021, production dropped:

–5.7% in 2022

–6.5% in 2023

+2.2% rebound in 2024

Even after this recovery, 2024 pigmeat production was still 2.3 million tonnes below the 2021 peak.

Poultrymeat

Poultry shows the opposite trend.

From 2009 to 2020, production increased by 33.3%

Small declines in 2021 (–2.9%) and 2022 (–1.5%)

Growth returned in 2023 (+2.3%) and accelerated in 2024 (+6.0%)

Poultry is clearly the fastest-growing meat sector in the EU.

Beef, sheep and goat meat

Red meat from ruminants continues to shrink:

Bovine meat: –5.1% since 2009

Sheepmeat: –17.2%

Goatmeat: –38.3%

These sectors face high costs, labour shortages, and strong environmental and welfare pressure.

Meat production is concentrated in a few countries

A small number of countries dominate EU meat output.

Pigmeat (2024)

Spain: 5.0 million tonnes (23.5% of EU total)

Germany: 20.3%

France: 9.9%

Poultrymeat

Poland: 2.9 million tonnes (20.5%)

Spain: 12.8%

France: 12.2%

Germany: 10.9%

Bovine meat

France: 1.3 million tonnes (19.7%)

Germany: 15.3%

Spain: 10.9%

Italy: 10.0%

Poland: 9.7%

Ireland: 9.2%

This concentration increases efficiency, but also creates risk when disease, trade issues, or regulation affect key countries.

Prices: high volatility, especially for pigs

Meat prices do not move together.

In 2024:

Sheep and goat prices: +11.4%

Cattle prices: +3.9%

Poultry prices: –5.3%

Pig prices: –7.4%

Pig prices were the most volatile over recent years:

+25.3% in 2022

+22.8% in 2023

then falling again in 2024

This volatility makes long-term planning difficult for farmers, processors, and retailers.

Meat remains economically important

In 2024, total EU agricultural output was worth €531.9 billion.

Animal production accounted for €218.8 billion, or 41.1% of this total.

Within animal output:

Milk: €78.6 billion

Pigs: €46.8 billion

Cattle: €38.4 billion

Even with declining volumes, meat remains a core pillar of EU agriculture.

Labour and farm structure are under pressure

Agriculture employed 8.4 million people in the EU in 2023, only 3.9% of total employment, down from 5.2% in 2013.

Other key facts:

Average working week in agriculture: 40.6 hours

Share of self-employed workers: 53.7%

Farm managers aged 65 or over: 32.6%

Farm managers under 40: 12.2%

Many small livestock farms are disappearing, pushing the meat sector toward larger, more capital-intensive operations.

Stronger animal-welfare rules are coming

EU policy plans include:

New slaughter legislation

Phasing out animal cages

Aligning welfare standards for imports with EU rules

These changes aim to improve sustainability and ethics, but they also increase costs and investment needs, especially for small and medium producers.

What all this means for the meat industry

The data shows a clear direction:

The EU will produce less meat overall

Poultry will continue to expand

Pigmeat will remain large but unstable

Beef, sheep and goat meat will become more niche and premium

Regulation and costs will keep rising

Final message

The European meat industry is not collapsing — but it is shrinking, concentrating, and changing fast.

Companies that understand the numbers behind these trends will be better prepared for a future.

Source: https://ec.europa.eu/eurostat/web/products-key-figures/w/ks-01-25-049