Published in Market Analysis

EU Meat Prices Stay High in 2026

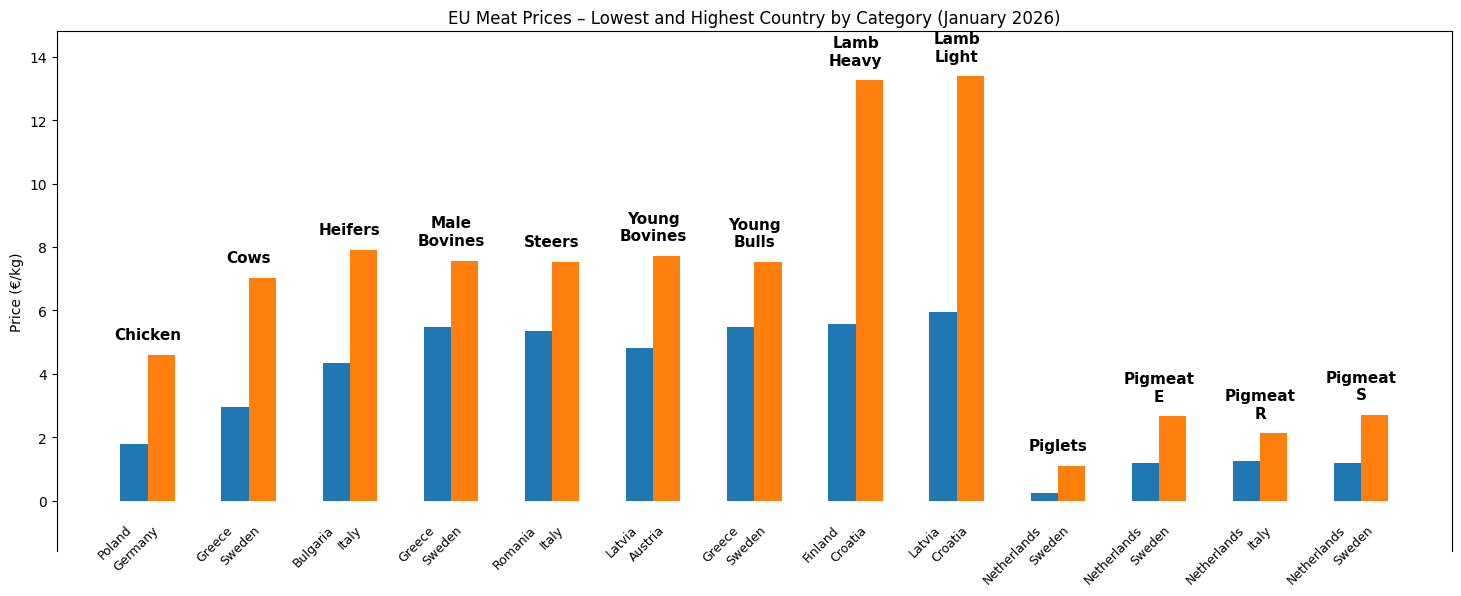

EU meat prices were still high in January 2026, as tight supply in 2025 continued to affect beef, lamb, and pigmeat markets across Europe.

Martina Osmak

Director of Marketing

Introduction

This report looks at meat prices across European Union countries in January 2026 and compares them with price trends seen during 2025. Prices are shown in euros per kilogram (€/kg), which makes them easier to understand and compare internationally.

In 2025, meat prices increased unevenly across countries and categories. Beef and lamb prices rose strongly due to lower animal numbers, while pigmeat stayed cheaper but moved up and down more. The January 2026 data show that many of these patterns continued into the new year, with large price differences still visible between countries.

Key Takeaways at a Glance

Meat prices in the EU stayed high in January 2026, continuing the trend seen throughout 2025 rather than cooling down at the start of the new year.

Beef and lamb remain the most expensive categories, with prices close to last year’s highs. Fewer animals available for slaughter continue to limit supply, keeping prices under pressure.

Lamb prices stand out the most, especially in Southern and Eastern Europe. In some countries, lamb prices are more than double those seen in lower-priced markets.

Pigmeat is still cheaper than beef and lamb, but prices vary widely between countries. The pig sector remains unstable, with prices moving up and down depending on supply and farmer expectations.

Chicken remains the most affordable protein, but prices also differ strongly across countries, reflecting different production costs and market structures.

Large price gaps between countries continue across all meat types, showing that differences in farming systems, scale, and local demand still matter as much as overall EU supply.

For readers short on time, these points capture the main message: high prices, limited supply, and big differences between countries are likely to remain key features of EU meat markets in early 2026.

Chicken

EU average: €2.87/kg

Lowest price: Poland (€1.80/kg)

Highest price: Germany (€4.60/kg)

Chicken prices in January 2026 differed widely across countries. Poland remained one of the cheapest producers, while Germany recorded much higher prices. Compared with red meat, chicken stayed relatively affordable and continued to benefit from consumers choosing cheaper protein options as beef and lamb prices stayed high.

Cows (Beef)

EU average: €6.15/kg

Lowest price: Greece (€2.96/kg)

Highest price: Sweden (€7.03/kg)

Cow meat prices in January 2026 matched the high levels reached at the end of 2025. Prices had risen steadily throughout 2025 as fewer cows were available for slaughter. Greece again showed the lowest prices, while Sweden remained among the most expensive markets. The large price gap between countries reflects differences in farming systems, costs, and consumer purchasing power.

Heifers (Beef)

EU average: €7.32/kg

Lowest price: Bulgaria (€4.35/kg)

Highest price: Italy (€7.90/kg)

Heifer prices stayed high in early 2026 after rising sharply during 2025. Italy continued to record the highest prices, while Bulgaria remained at the lower end. High prices partly reflect farmers keeping more female cattle for breeding, which reduced the number sent to slaughter.

Male Bovines (Beef)

EU average: €7.19/kg

Lowest price: Greece (€5.49/kg)

Highest price: Sweden (€7.57/kg)

Prices for male bovines stayed close to the levels seen at the end of 2025. Differences between countries were smaller than in some other beef categories, showing that overall beef supply conditions, rather than local factors, were the main driver.

Steers (Beef)

EU average: €7.17/kg

Lowest price: Romania (€5.35/kg)

Highest price: Italy (€7.52/kg)

Steer prices remained high in January 2026, following strong increases during 2025. Italy again recorded the highest prices, while Romania stayed well below the EU average. Prices appeared to level off rather than continue rising sharply.

Young Bovines (Beef)

EU average: €7.25/kg

Lowest price: Latvia (€4.81/kg)

Highest price: Austria (€7.71/kg)

Young bovine prices stayed close to the upper levels reached in 2025. Austria continued to post high prices, while Latvia remained among the cheapest. This suggests that the reduced supply of young animals seen last year is still affecting the market.

Young Bulls (Beef)

EU average: €7.30/kg

Lowest price: Greece (€5.49/kg)

Highest price: Sweden (€7.52/kg)

Young bull prices were similar across most countries and remained high. Compared with 2025, prices showed signs of stabilising rather than increasing further.

Lamb – Heavy

EU average: €9.41/kg

Lowest price: Finland (€5.58/kg)

Highest price: Croatia (€13.25/kg)

Heavy lamb prices stayed very high in January 2026. Croatia again recorded the highest prices, while Finland was at the lower end. Limited sheep numbers and strong demand continued to support prices across much of Europe.

Lamb – Light

EU average: €10.04/kg

Lowest price: Latvia (€5.94/kg)

Highest price: Croatia (€13.38/kg)

Light lamb prices were even higher than heavy lamb prices. Large differences between countries remained, with Croatia consistently at the top. Seasonal demand and low supply made this category particularly sensitive to price changes.

Piglets

EU average: €0.44/kg

Lowest price: Netherlands (€0.24/kg)

Highest price: Sweden (€1.09/kg)

Piglet prices continued to vary strongly between countries. The Netherlands recorded very low prices due to large-scale production, while Sweden showed much higher prices linked to smaller supply. Piglet markets remained unpredictable, as they depend heavily on farmer expectations.

Pigmeat – Class E

EU average: €1.51/kg

Lowest price: Netherlands (€1.19/kg)

Highest price: Sweden (€2.66/kg)

Class E pigmeat prices in January 2026 were similar to the ranges seen in 2025. Northern countries showed higher prices, while the Netherlands remained among the cheapest suppliers.

Pigmeat – Class R

EU average: €1.95/kg

Lowest price: Netherlands (€1.24/kg)

Highest price: Italy (€2.12/kg)

Class R prices stayed firm but did not rise sharply. Italy continued to record higher prices due to strong local demand for pork products.

Pigmeat – Class S

EU average: €1.49/kg

Lowest price: Netherlands (€1.20/kg)

Highest price: Sweden (€2.70/kg)

Class S pigmeat showed the largest price gap among pig categories. Sweden recorded much higher prices than most other countries, while the Netherlands remained the cheapest.

Conclusion

The January 2026 data confirm that the main trends from 2025 are still shaping EU meat markets. Beef and lamb prices remain high because fewer animals are available, while pigmeat stays cheaper but continues to move up and down. Large price differences between countries persist, showing how production costs, scale, and local demand continue to shape meat prices across Europe.

Sources: