The Search for Buyers: EU Pork Faces Hard Landing After China Tariffs

China’s company-specific tariffs leave EU pork exporters scrambling for alternative buyers as prices fall and trade diplomacy stalls.

Some European pork exporters report having containers of product returning from China after being placed in the highest tariff band of 62.4%. Those shipments, originally destined for Chinese buyers, are now being redirected within Europe or to alternative markets across Asia and even Africa.

China’s provisional anti-dumping duties on EU pork, announced on 10 September, vary sharply by company, from as low as 15.6% for cooperating firms to 62.4% for non-cooperators. Several large producers fall in the middle range of 25–33%. The measures are provisional and will remain in effect until 16 December 2025, when Beijing’s Ministry of Commerce is due to issue its final ruling. Until then, importers must pay cash deposits equivalent to the provisional duty rate, pending refund or confirmation.

Price pressure mounts

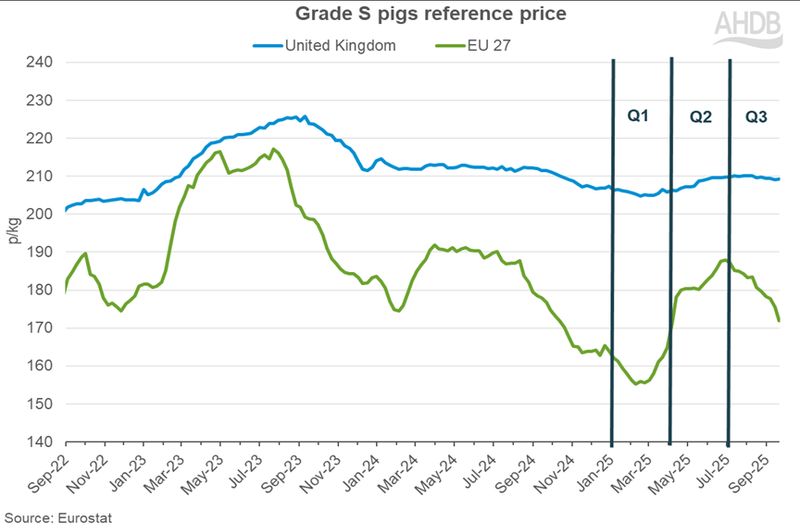

With China, previously the EU’s single largest pork market, out of reach for higher-tariffed exporters, the immediate result has been a rise in available European supply. EU reference prices have been sliding for several months, with the Grade S average down to 168.7 p/kg in late September, about 40 p/kg below the GB standard price. The UK market, by contrast, has remained broadly stable, and continues to show much lower volatility than the EU benchmark.

Limited policy movement

The final outcome of China’s anti-dumping probe remains open, but there is little indication that either side is prioritising a negotiated solution. For now, the EU’s response options are constrained.

While Brussels would prefer to see tariffs lifted on goods where it runs a surplus, such as agricultural exports, it has simultaneously tightened its stance in sectors where it faces Chinese overcapacity. Countervailing duties of 17–35.3% (on top of the 10% base tariff) are already in place on Chinese electric vehicles, and in early October the European Commission proposed halving steel import quotas and raising out-of-quota tariffs to 50%, though that measure still requires approval.

This mix of policies complicates diplomacy. Some EU member states, including Hungary and Spain, are actively courting Chinese investment in electric-vehicle or battery plants to localise production and ease tariff exposure, further fragmenting the bloc’s negotiating position.

Production inertia

Several major European pork processors report keeping production steady despite falling prices, citing contracts and sunk costs. Whether this proves prudent or short-sighted remains to be seen. If output continues at current levels while export opportunities shrink, downward price pressure is likely to persist through the fourth quarter. A deeper correction could follow should the December ruling confirm the higher tariff bands.

At the same time, European producers continue to face African Swine Fever (ASF) restrictions that limit access to some non-EU markets, compounding the challenge of re-routing displaced Chinese volumes. Even if production cuts begin later in the year, the inertia of existing supply suggests the market may need months to rebalance.

Outlook

With no clear path to a trade compromise, a widening UK-EU price gap, and ongoing sanitary barriers, the short- to medium-term bias for European pork prices remains downward. Much depends on whether exporters can cultivate new buyers in markets such as the Philippines, Mexico, or Vietnam, which are already absorbing small additional volumes but cannot yet replace Chinese demand. Unless a diplomatic breakthrough emerges before mid-December, the European pork sector faces a protracted period of price weakness as it searches for its new equilibrium.

Sources

Reuters – China slaps initial duties on EU pork imports (5 Sept 2025): https://www.reuters.com/world/china/china-slaps-initial-duties-eu-pork-imports-2025-09-05

Reuters – China’s retaliatory tariffs to squeeze EU pork producers (10 Sept 2025): https://www.reuters.com/world/china/chinas-retaliatory-tariffs-squeeze-eu-pork-producers-2025-09-10

Le Monde (EN) – China to impose temporary duties on European Union pork imports (5 Sept 2025): https://www.lemonde.fr/en/international/article/2025/09/05/china-to-impose-temporary-duties-on-european-union-pork-imports_6745068_4.html

AHDB – GB pig prices slip in the back end of Q3: Pork market update (30 Sept 2025): https://ahdb.org.uk/news/gb-pig-prices-slip-in-the-back-end-of-q3-pork-market-update

AHDB – UK and EU deadweight pig prices (2025): https://ahdb.org.uk/pork/eu-deadweight-pig-prices

Euromeat News – AHDB analysis: EU pig prices in decline (2025): https://euromeatnews.com/Article-AHDB-analysis%3A-EU-pig-prices-in-decline/6716