Europe’s Protein Powerhouses: Meat Snacks Surge and Chicken Stays King

Europe’s appetite for protein is growing fast — meat snacks are booming with innovation, while chicken continues to dominate production and consumption.

The Changing Protein Landscape in Europe

Europe is in the middle of a protein revolution. On one hand, traditional staples like chicken remain at the heart of diets, with millions of tons consumed each year. On the other, fast-growing segments like gourmet jerky and meat bars are transforming snacking habits. Together, they reflect a shift toward high-protein, convenient, and health-conscious eating across the continent.

Meat Snacks: The Fastest-Growing Player

Strong Market Growth Ahead

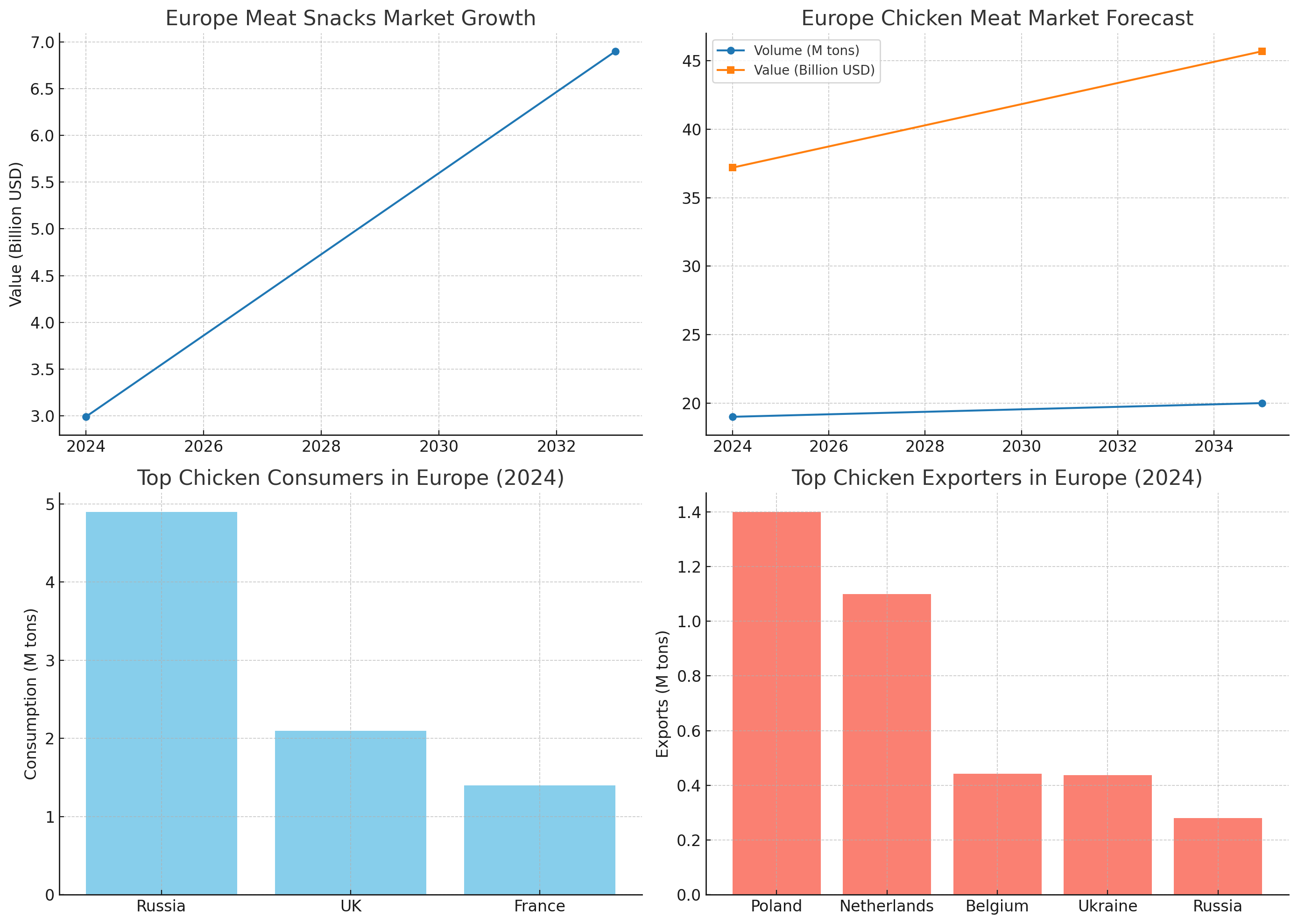

In 2024, Europe’s meat snacks market was valued at $2.99 billion. By 2033, it’s expected to hit $6.9 billion, growing at a CAGR of 9.79%. This surge is powered by consumers looking for on-the-go, high-protein foods that fit busy lifestyles.

Innovation and Premiumization

Classic products like jerky, sausages, and salami are being reinvented with healthier recipes, organic ingredients, and creative flavors. France and Germany lead the market with premium offerings, while new entrants experiment with regional specialties to cater to local tastes.

Health and Diet Trends

The popularity of keto, paleo, and low-carb diets has boosted demand. High-protein snacks support fitness goals, muscle recovery, and satiety — making them attractive to athletes, travelers, and busy professionals. Rising awareness of heart health and obesity (over 25% of adults in Europe are obese) is pushing demand for low-sugar, high-fiber meat snacks.

Expanding Sales Channels

Retail giants and online marketplaces are crucial growth drivers. Meat snacks are now widely available in supermarkets, convenience stores, and through e-commerce — often with subscription models and direct-to-consumer options.

Clean-Label and Organic Demand

Consumers increasingly seek natural, minimally processed products with transparent ingredient lists. Brands are responding with organic-certified and grass-fed options, aligning with Europe’s strong sustainability and ethical sourcing values.

Chicken: The Steady Protein Giant

Market Size and Forecast

Europe consumed 19 million tons of chicken in 2024, worth $37.2 billion. By 2035, demand is expected to rise to 20 million tons, with market value reaching $45.7 billion.

Leading Consumers and Producers

Russia: 4.9M tons consumed (27% of total), 5.1M tons produced (26% share)

UK: 2.1M tons consumed, 1.8M tons produced

France: 1.4M tons consumed

Netherlands: Highest per capita consumption at 41 kg per person

Trade Flows

Exports: 5.6M tons in 2024, valued at $14B. Poland and the Netherlands dominate, with Belgium, Ukraine, and Russia also key players.

Imports: 4M tons in 2024, valued at $11.6B. The Netherlands, France, UK, and Germany account for over half of all imports.

Product Mix

Fresh or chilled cuts and frozen cuts make up 90% of imports and the bulk of exports. Fresh or chilled cuts command the highest prices — around $3,141 per ton for exports and $3,251 per ton for imports.

Shared Growth Drivers

1. High-Protein Diet Popularity

Both meat snacks and chicken benefit from the rise of protein-focused diets and a move away from refined carbs.

2. Convenience and Accessibility

Chicken is a versatile cooking staple, while meat snacks offer ready-to-eat portability. Both are now widely available through expanded retail and online channels.

3. Health and Wellness

Consumers are increasingly looking for nutrient-rich foods that align with wellness goals, from low-sodium meats to additive-free snacks.

Challenges to Watch

Regulatory Pressure: Strict European food safety laws impact both processed meat snacks and poultry, especially around labeling, additives, and sodium limits.

Rising Production Costs: Fluctuating meat prices, labor costs, and sustainable farming investments put pressure on margins.

Sustainability Concerns: Ethical sourcing and environmental impact are becoming central to consumer choices, pushing companies toward greener supply chains.

Final Take

Meat snacks are Europe’s fastest-growing protein category, expected to more than double in less than a decade, while chicken remains the continent’s most-consumed animal protein. Both markets reflect the same consumer desires: high-quality protein, convenience, and healthier choices. As innovation meets tradition, Europe’s protein sector is set to remain a powerful driver in the global food economy well into the 2030s.

Sources: