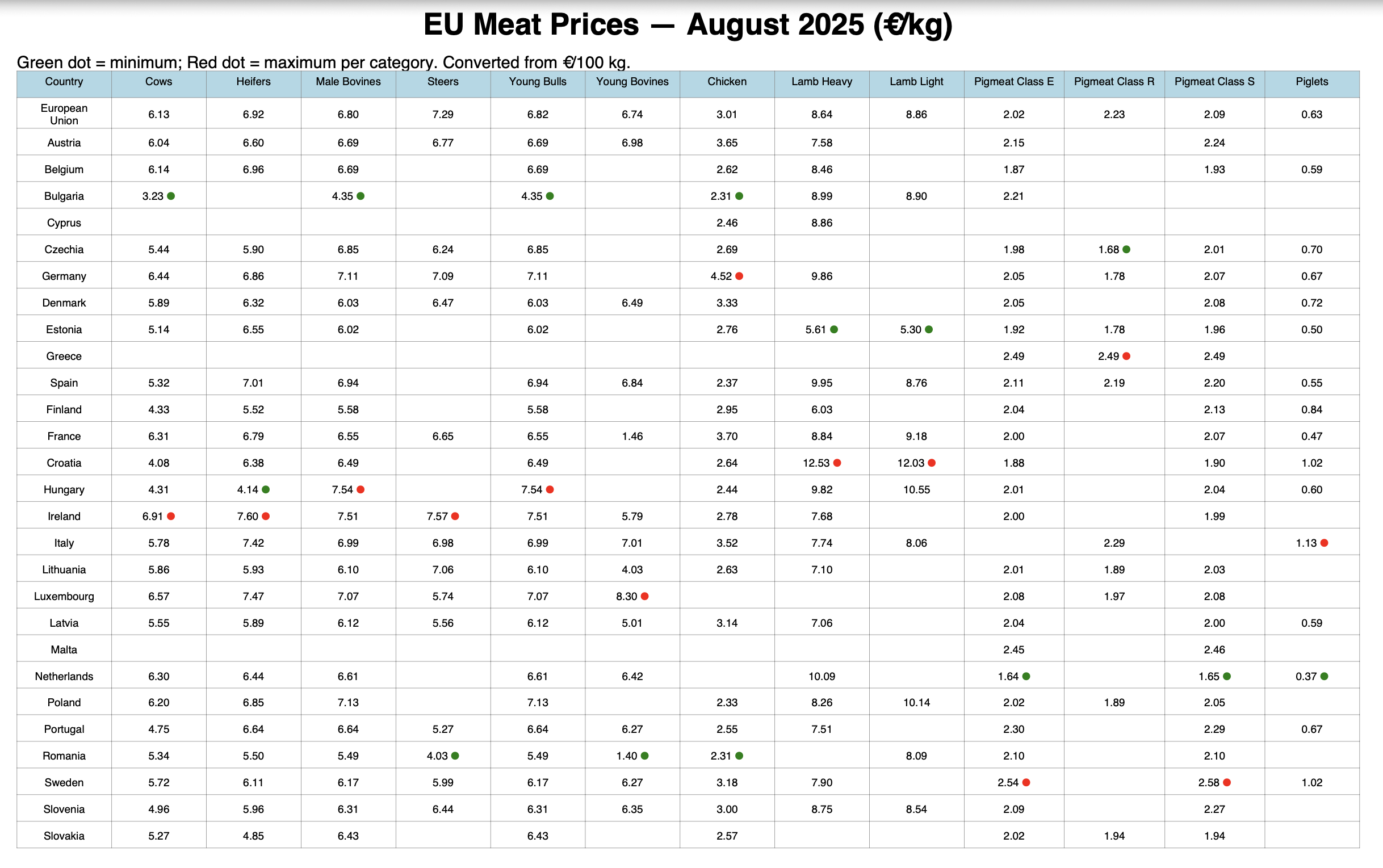

EU Meat Prices Report — August 2025 (€/kg)

Clear overview of European meat prices in August 2025, converted to €/kg, showing lowest and highest prices by country and changes compared to July.

Each month, the European Commission publishes official prices for meat in €/100 kg carcass weight. In this report, we convert them into €/kg so it’s easier for you—meat producers, traders, processors—to see what is happening in your country and across Europe.

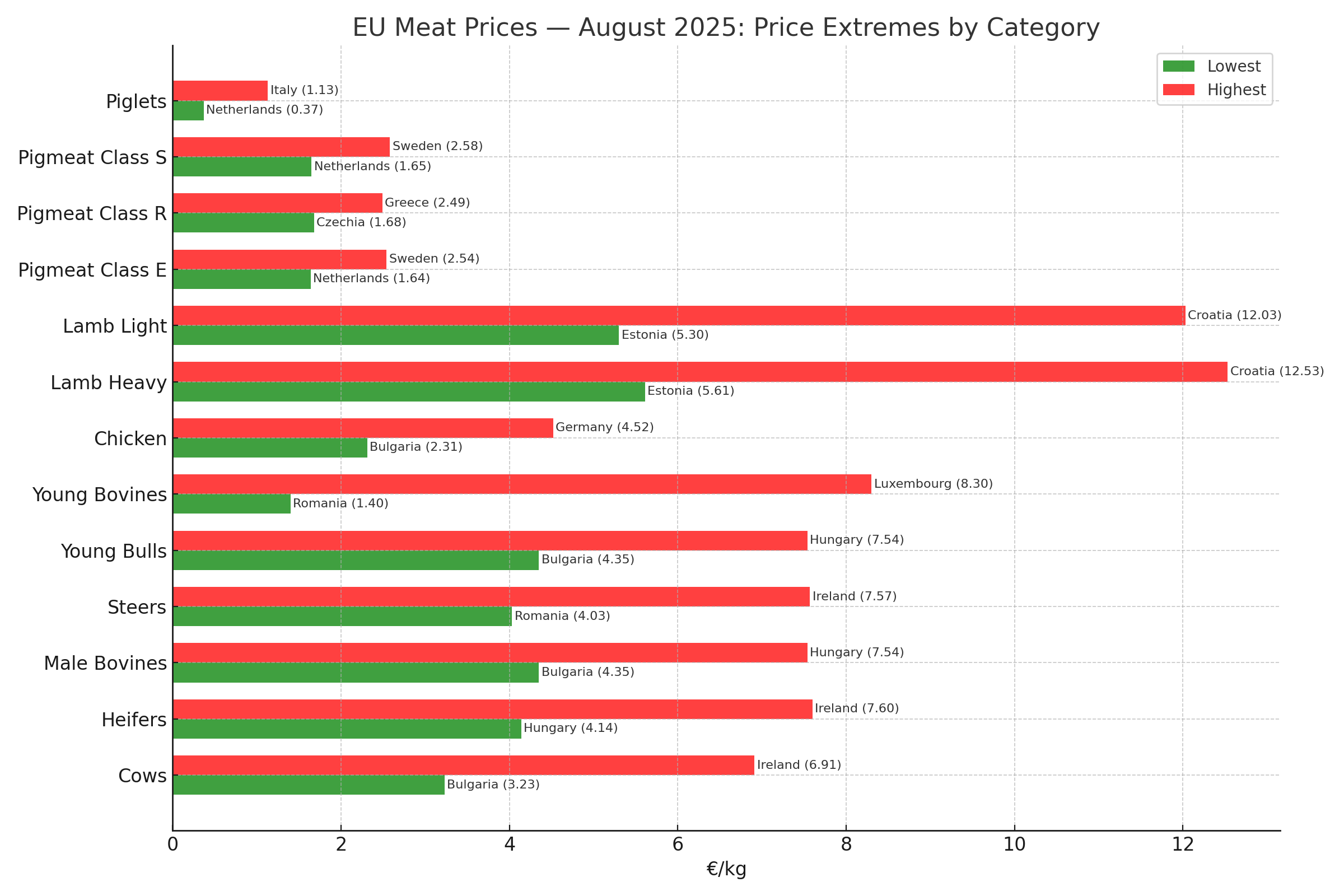

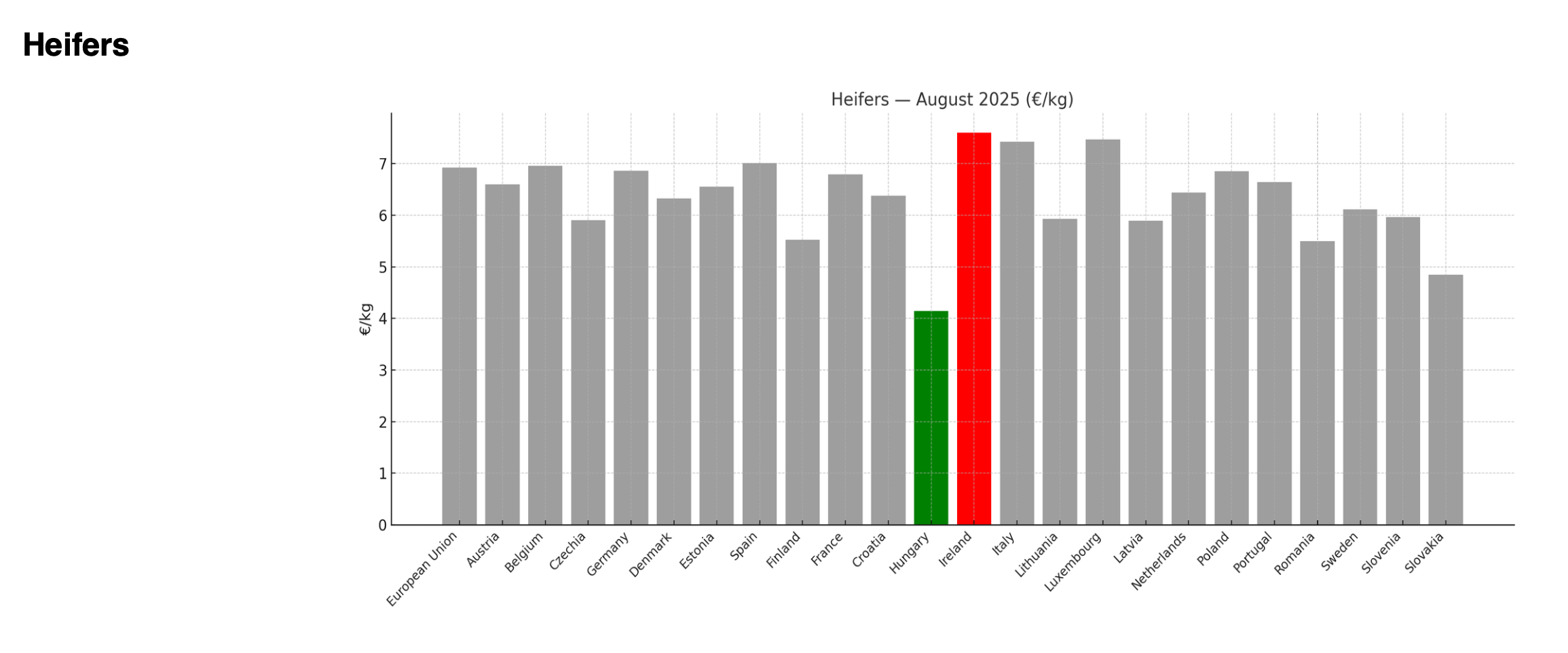

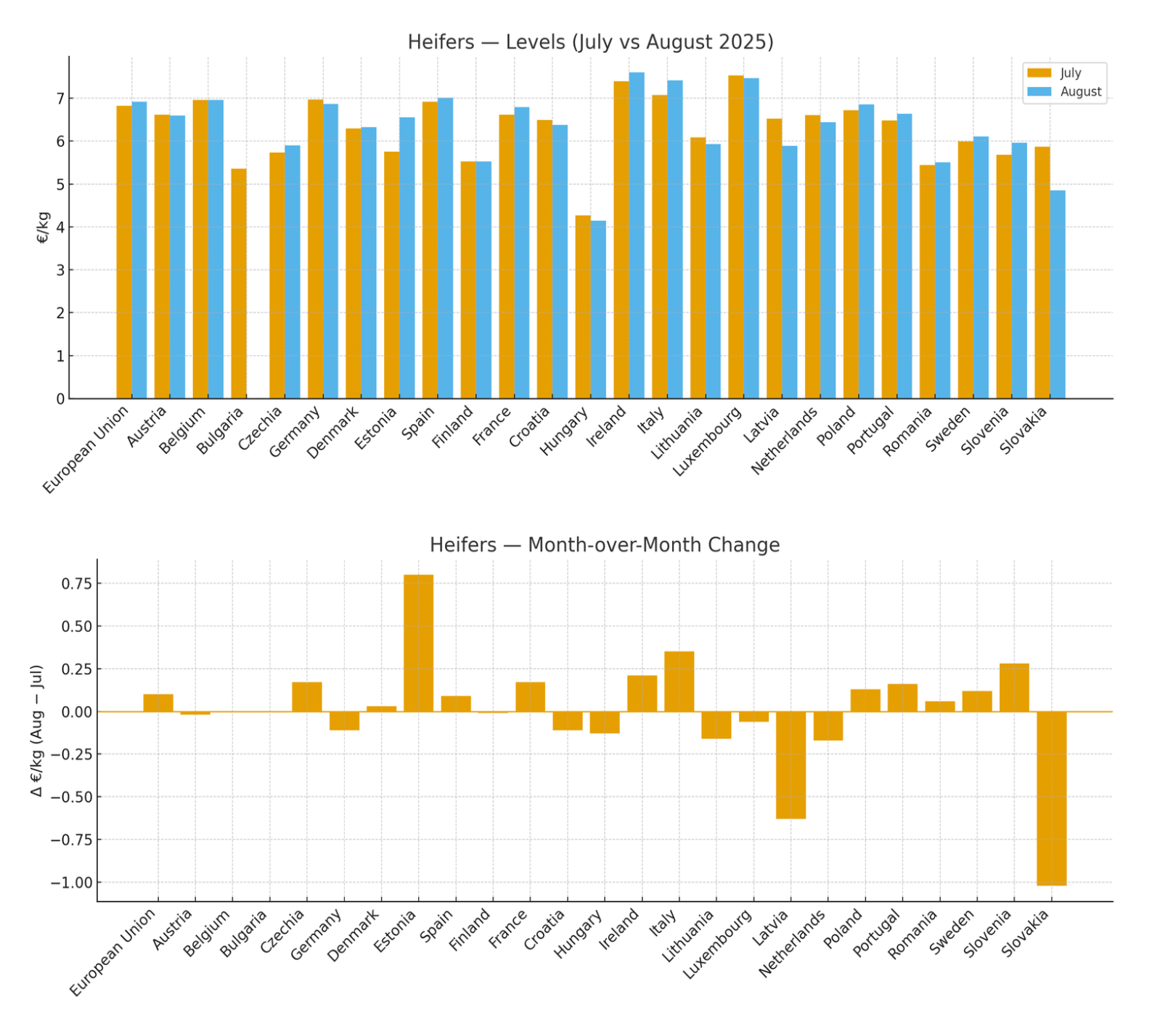

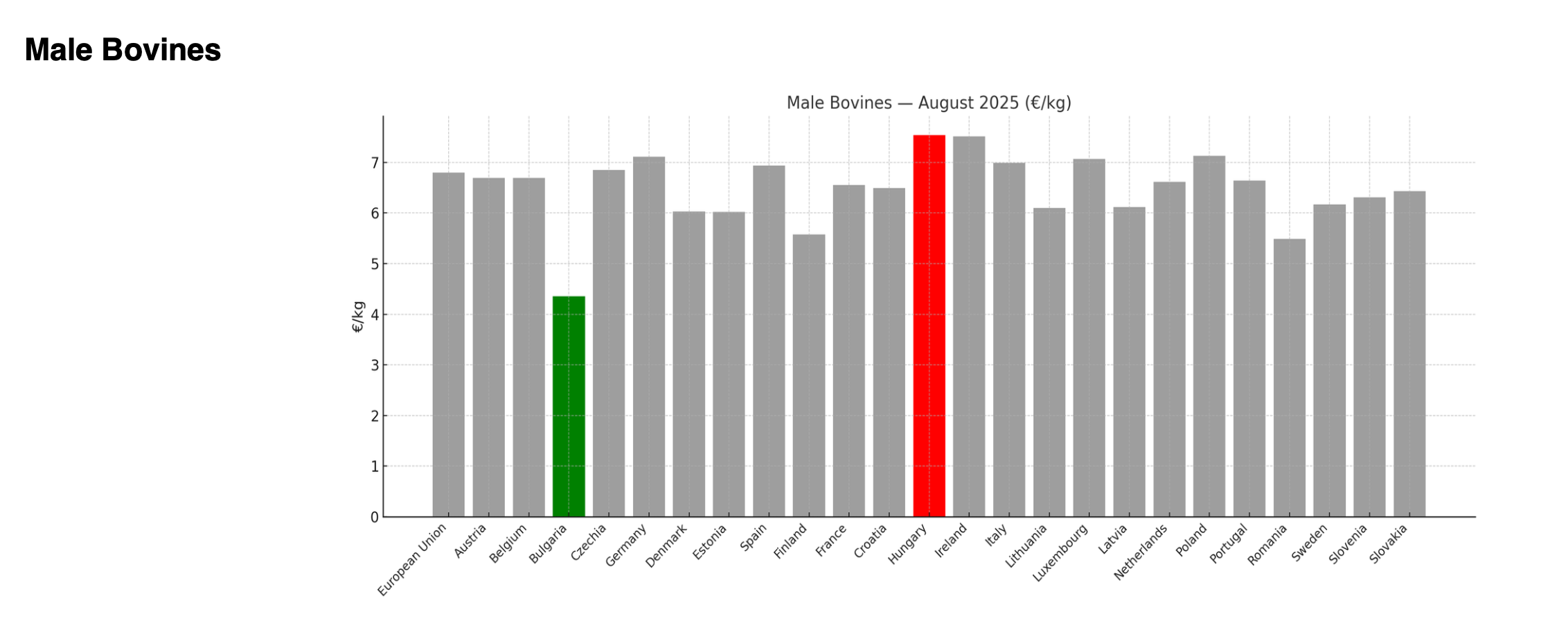

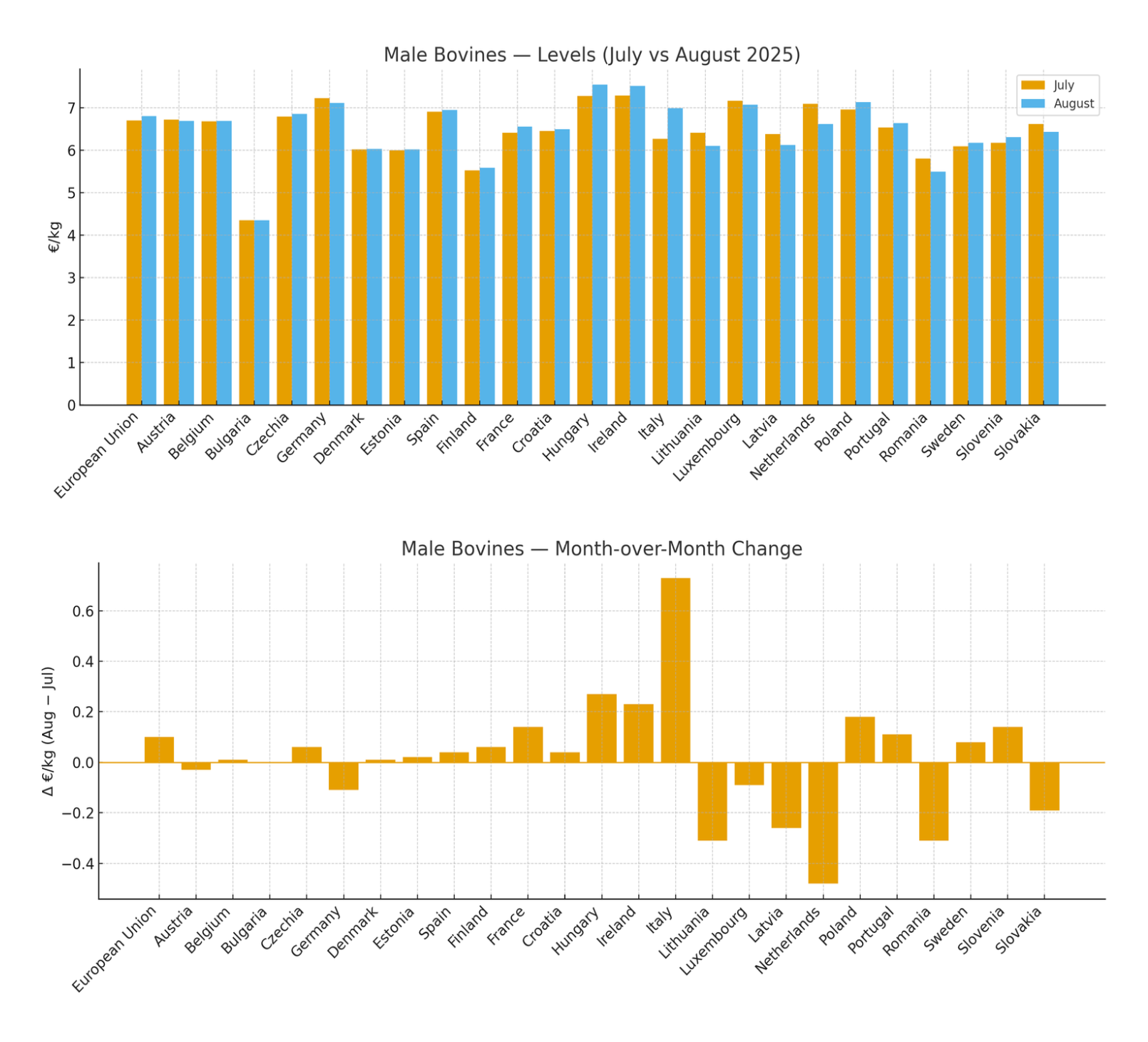

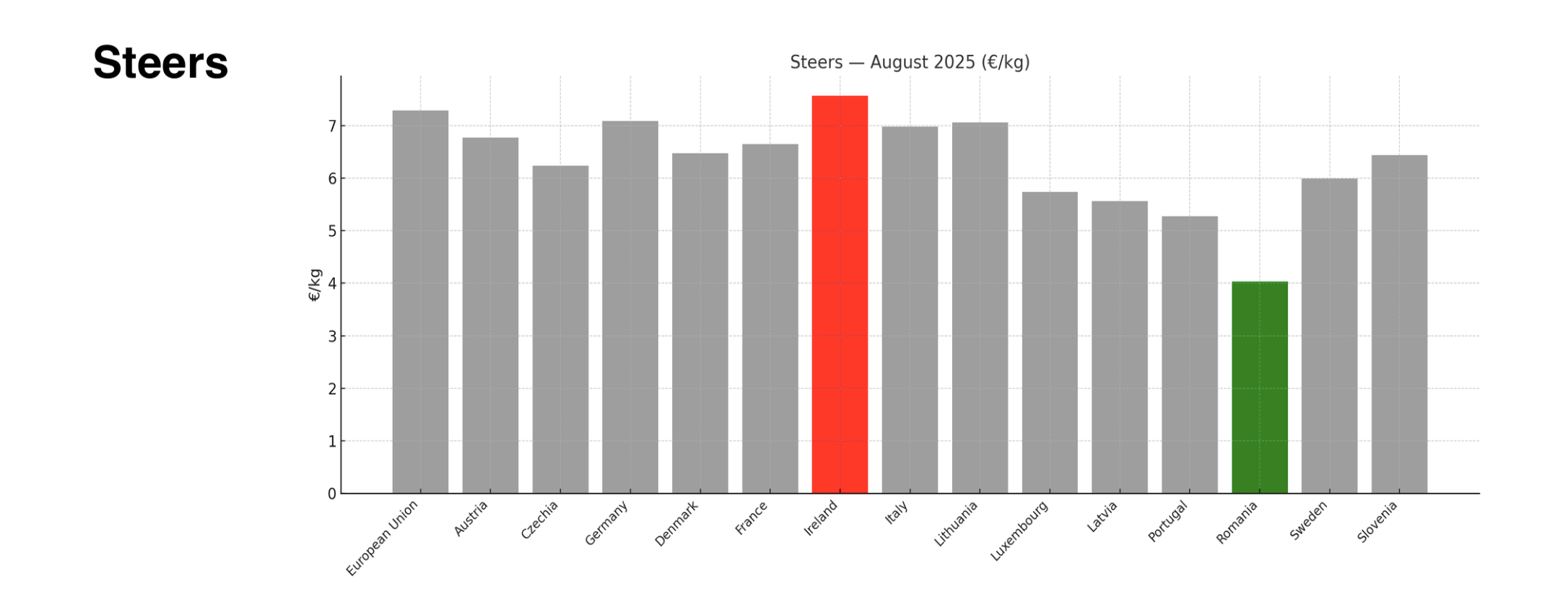

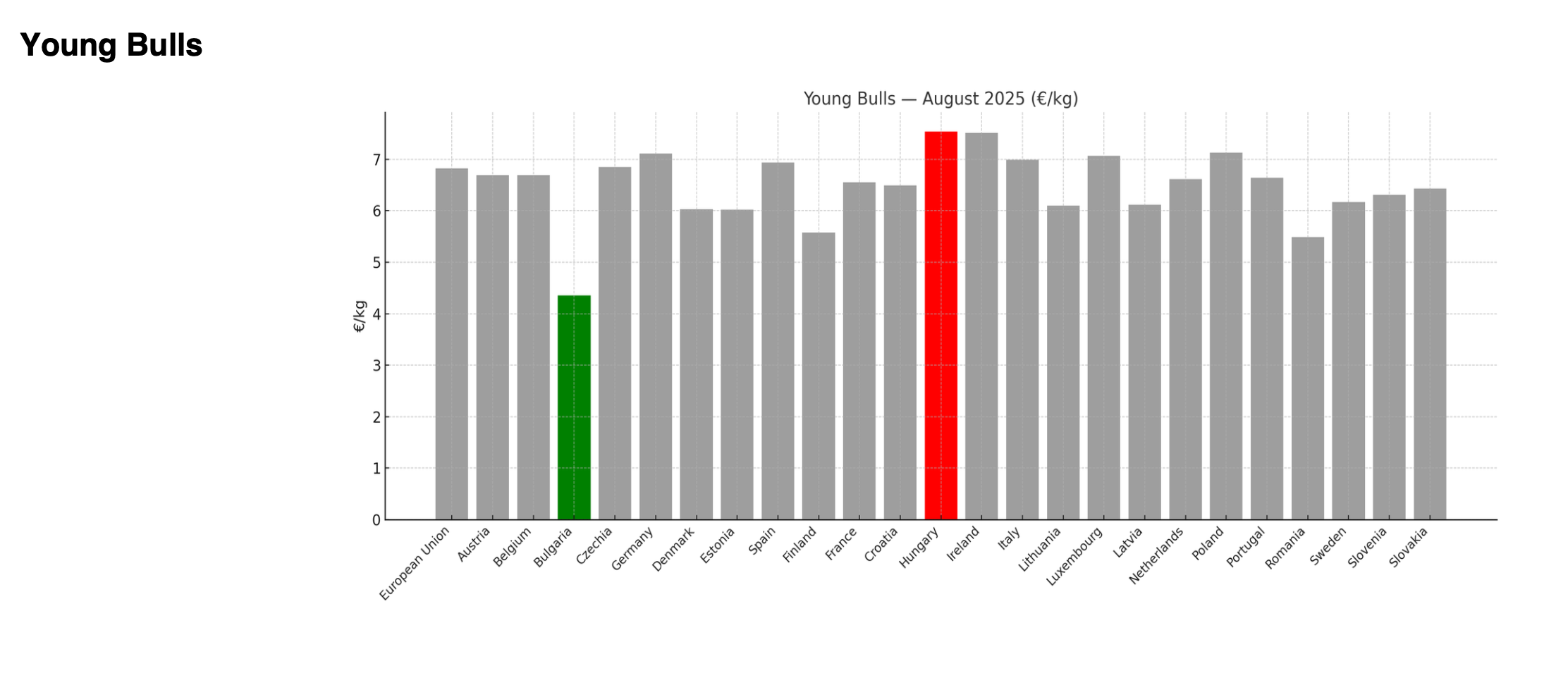

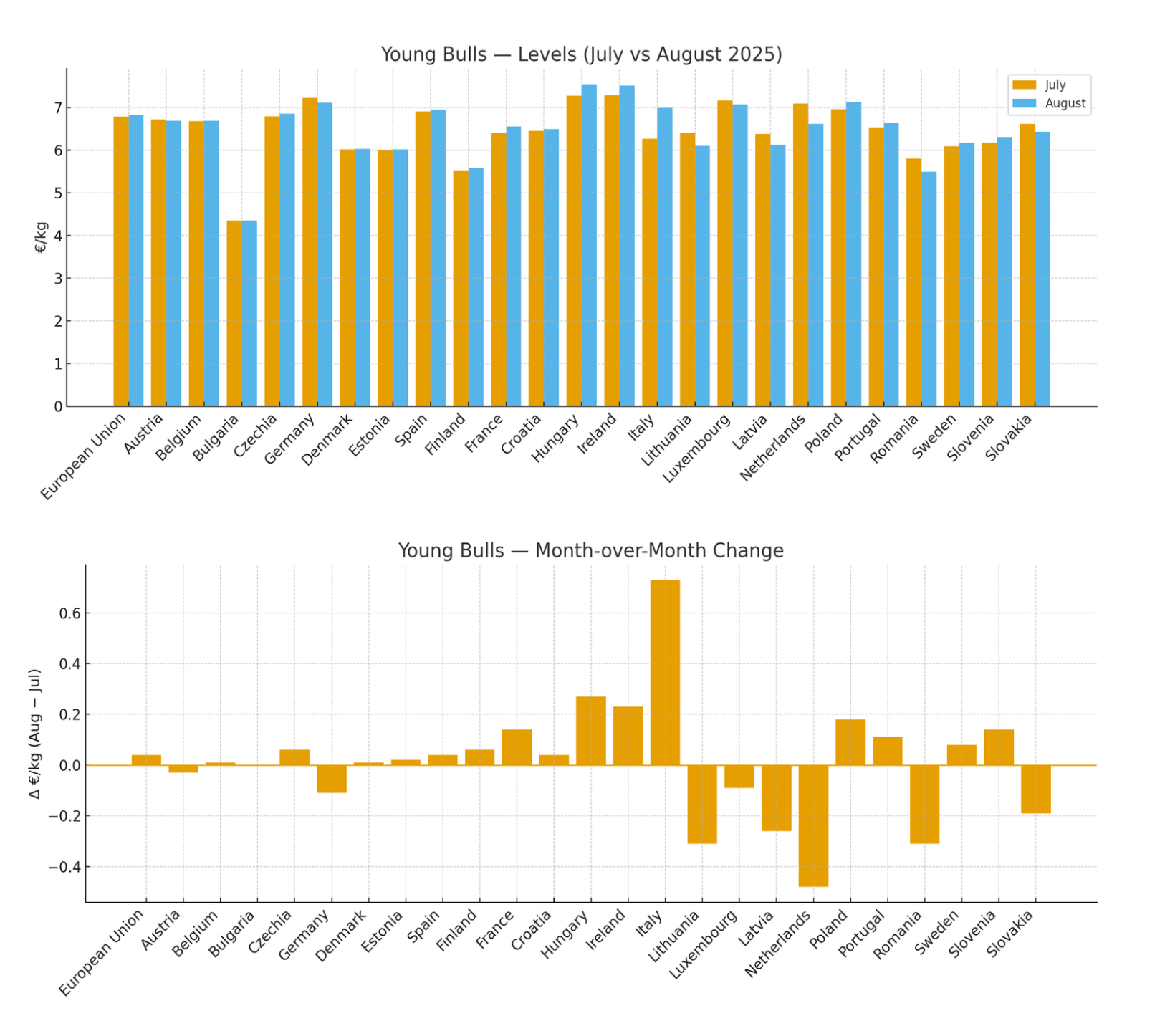

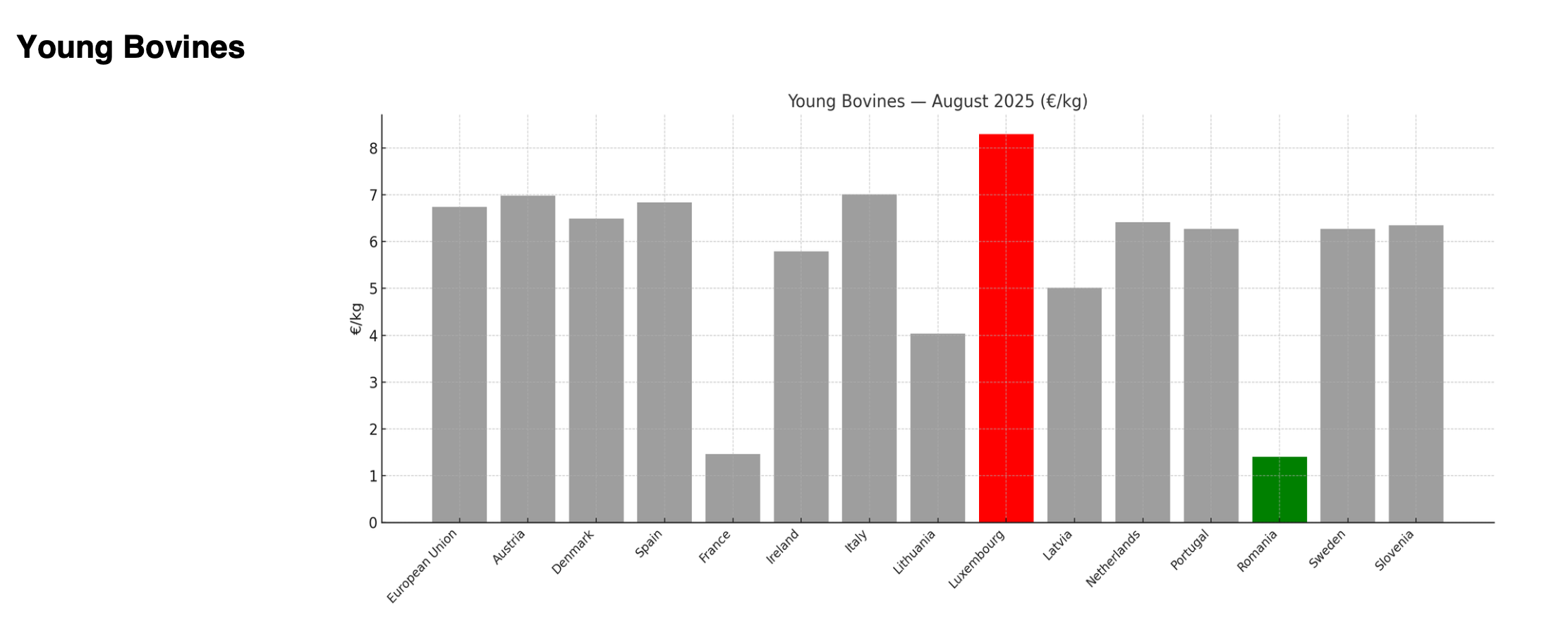

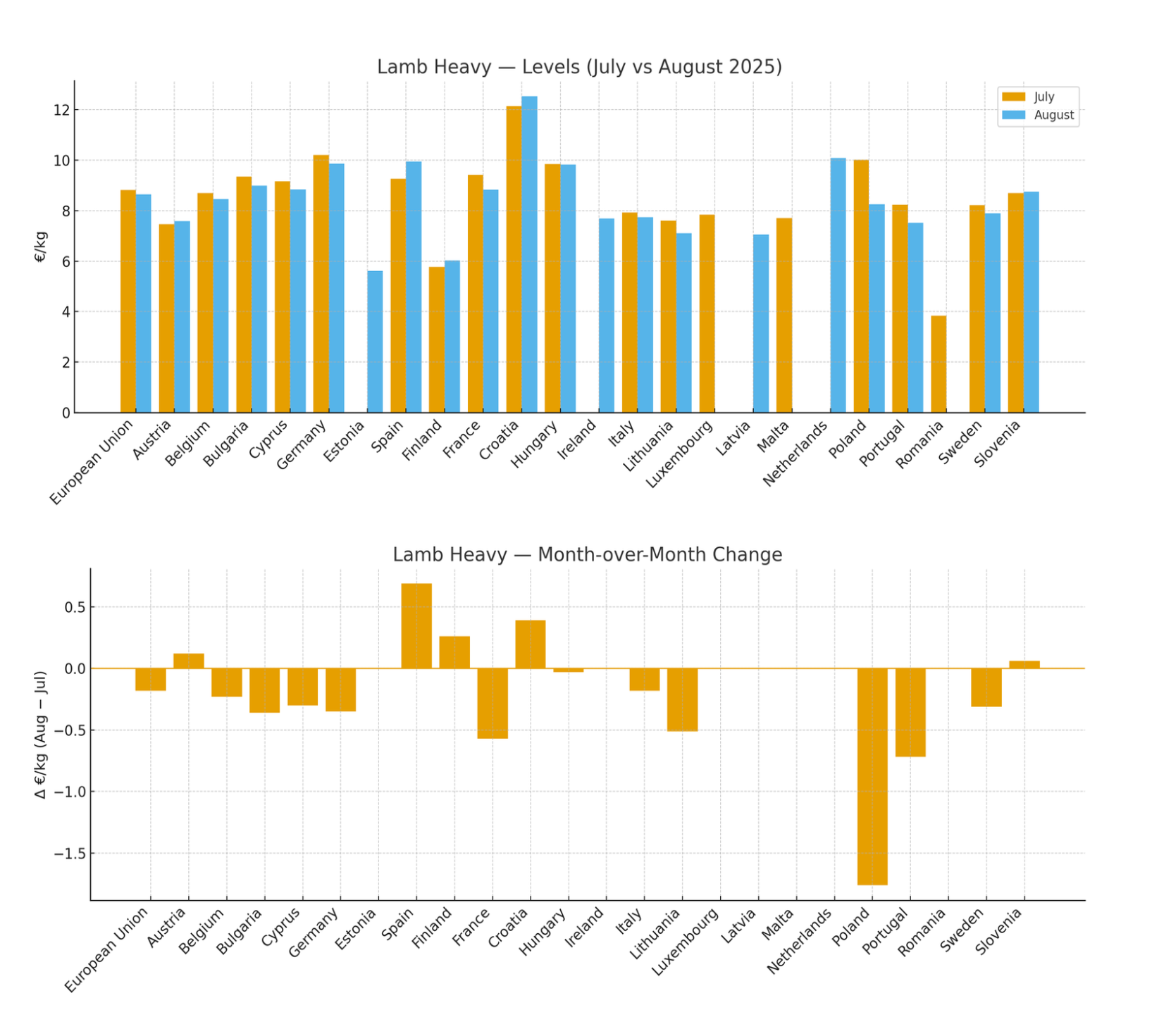

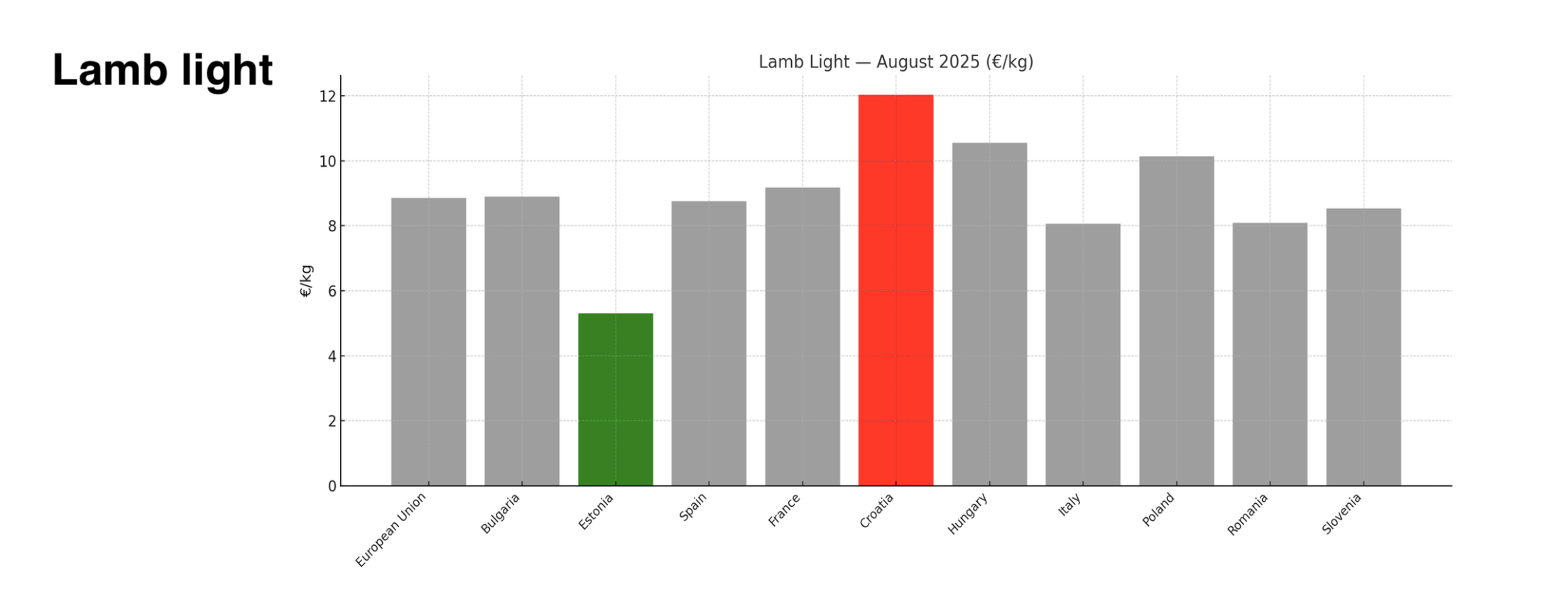

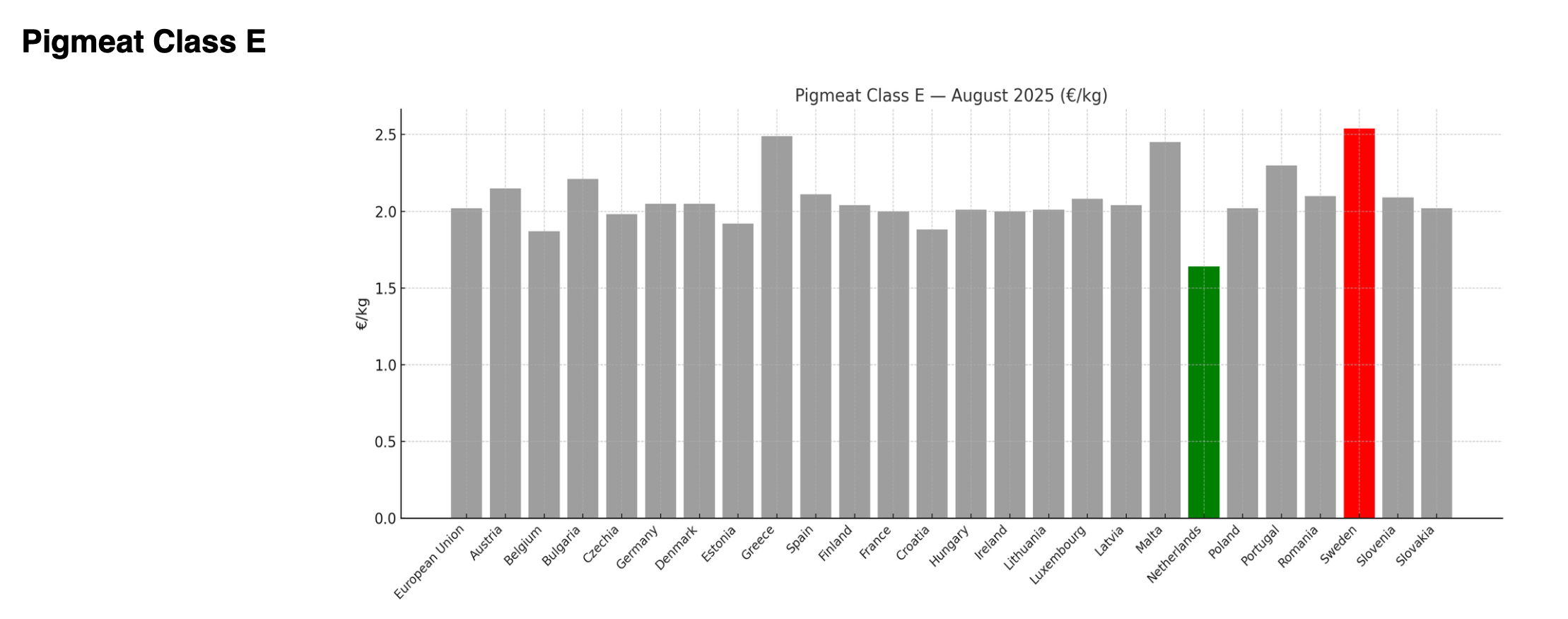

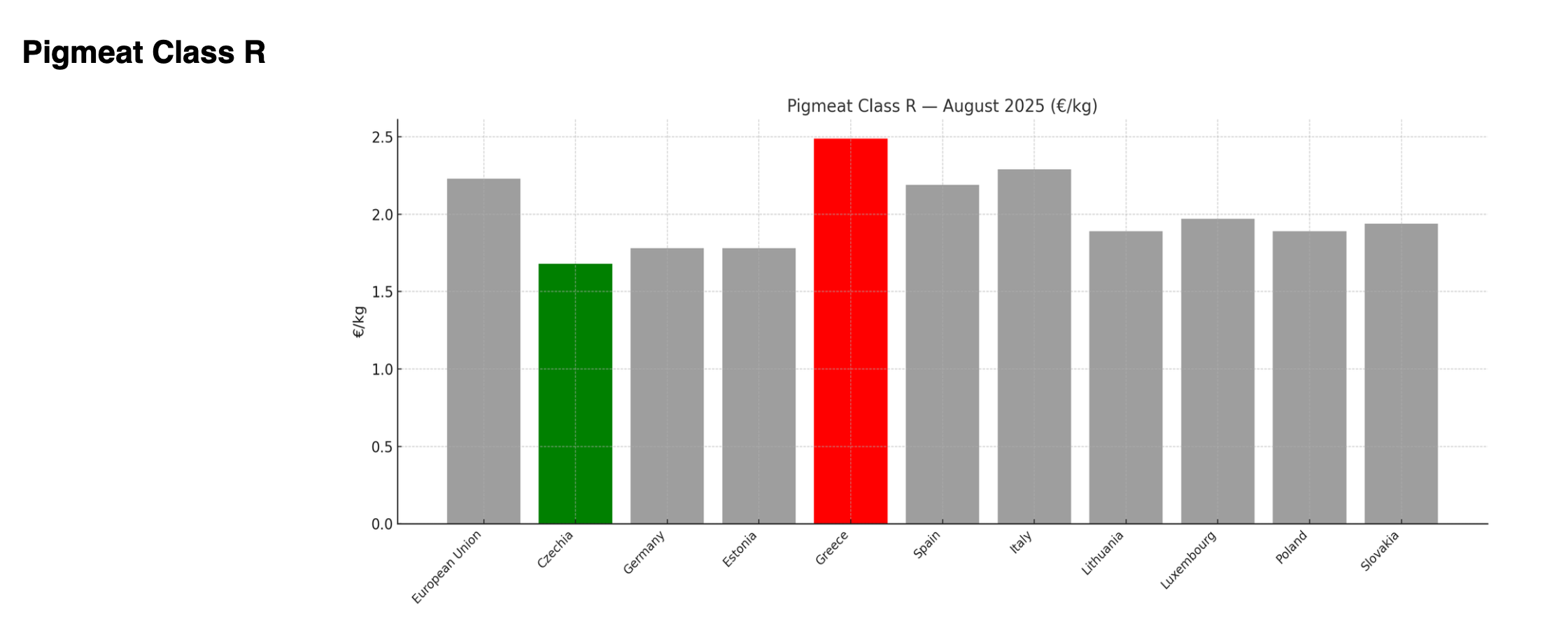

This is the August 2025 report. Alongside country-by-country, by-animal-type pricing, we’ve also compared August with July, so you can follow how prices are moving. Green dots mark the lowest in each category, red the highest.

What the Trends Look Like

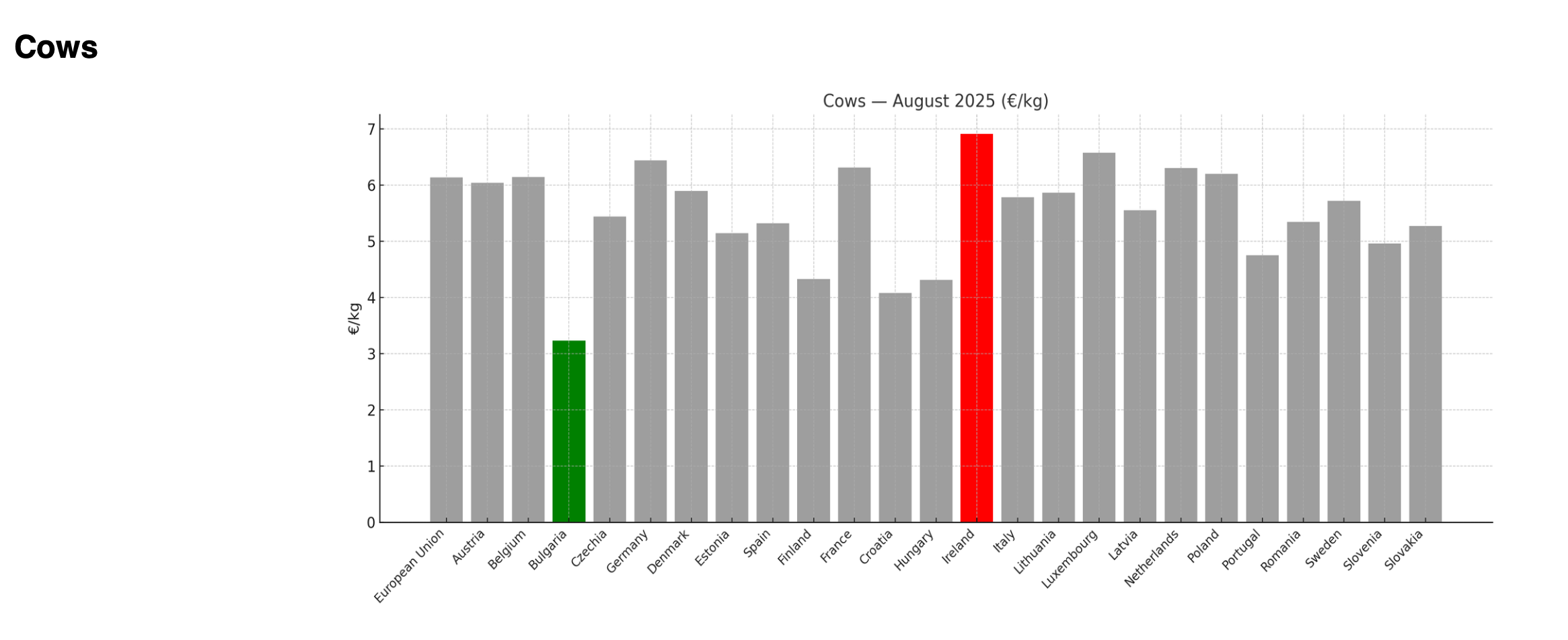

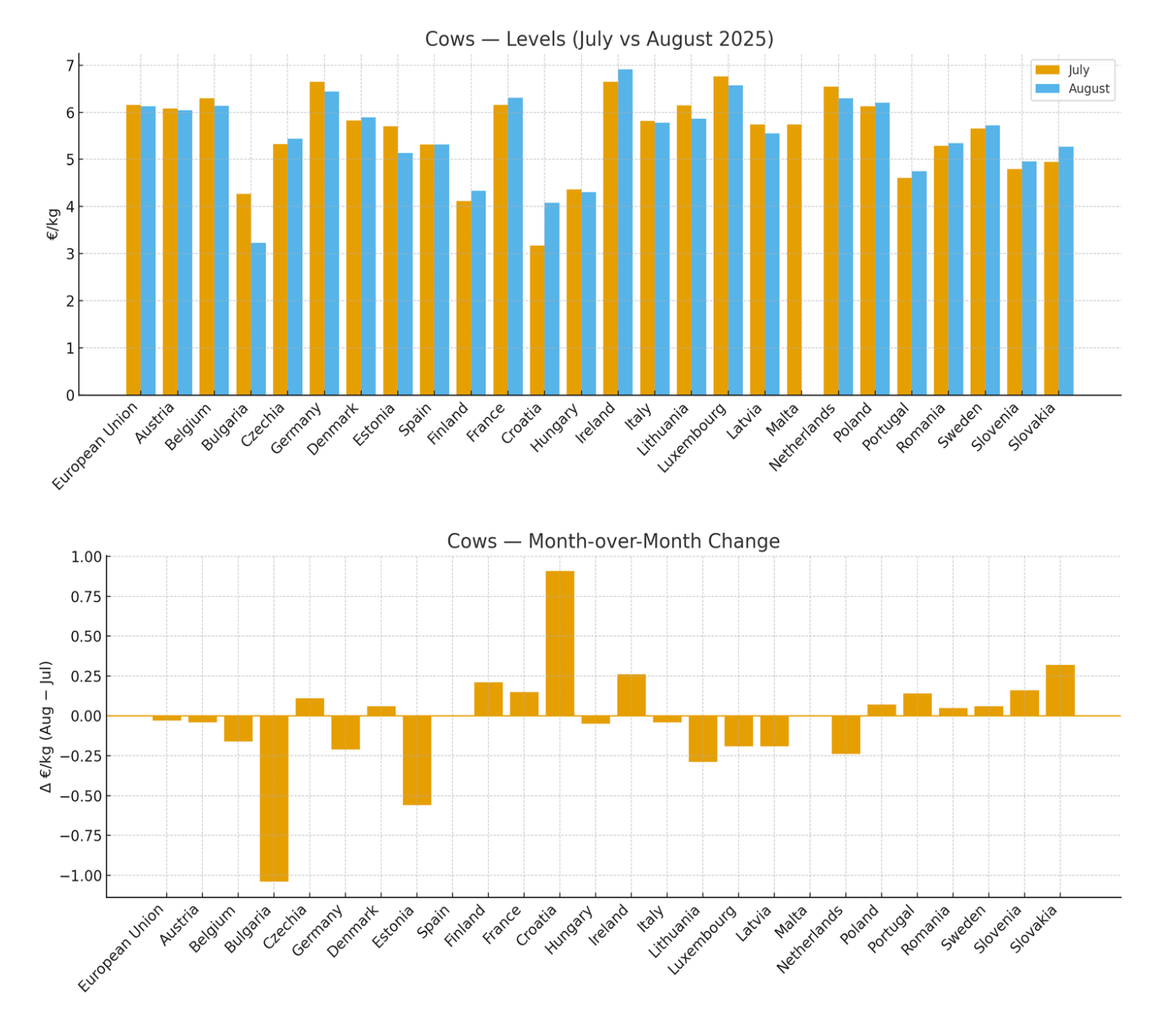

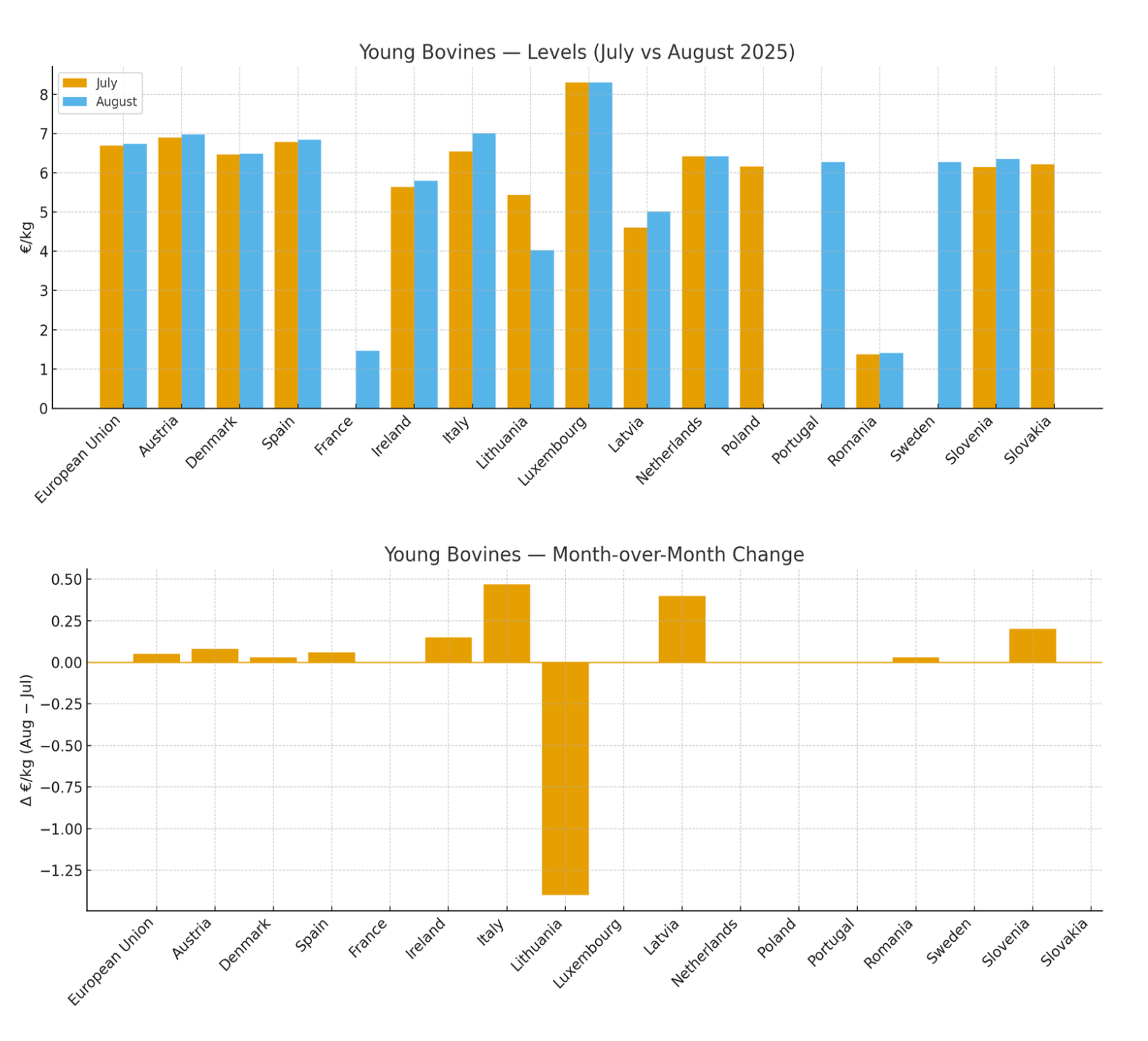

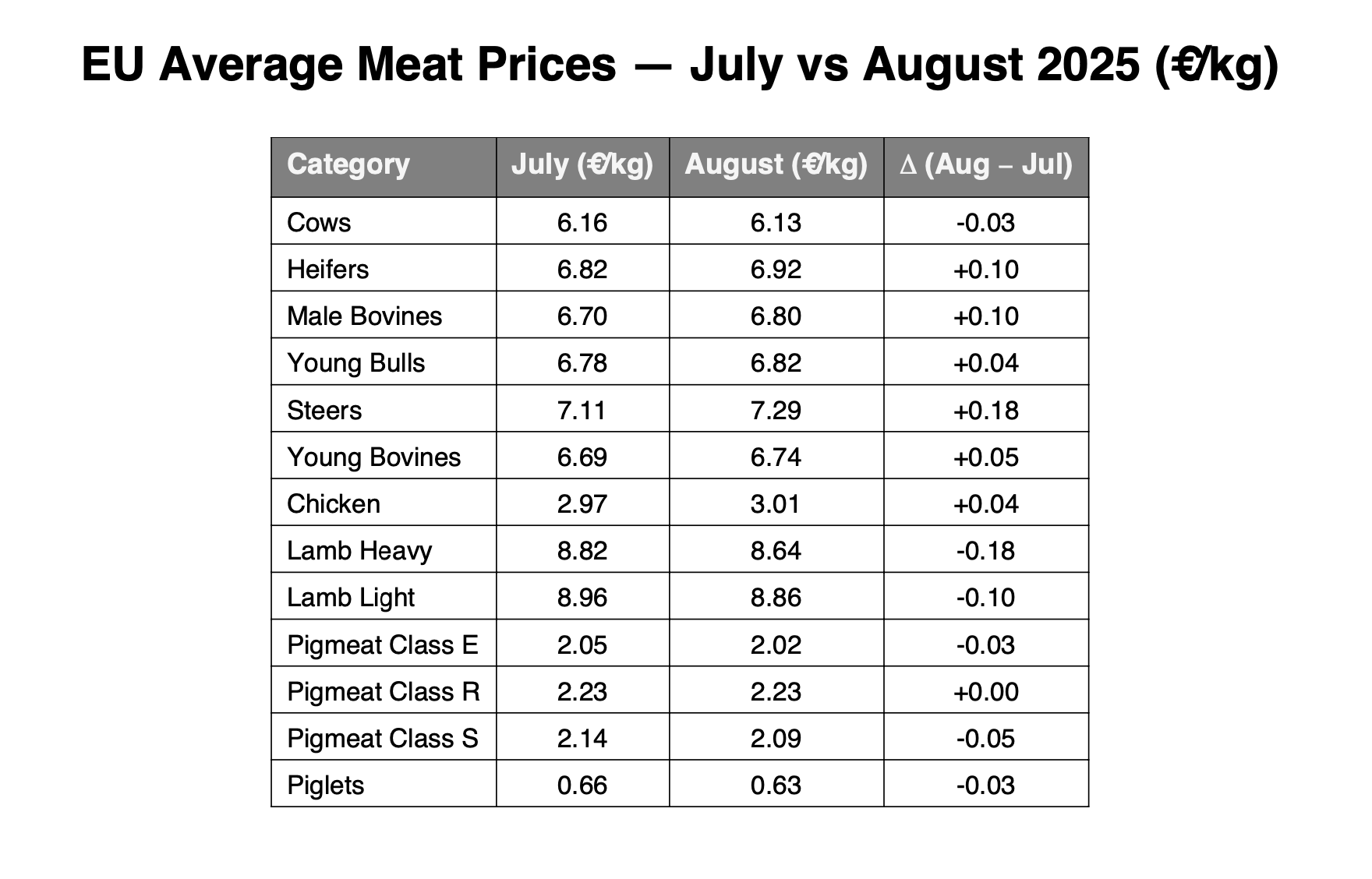

Prices for many beef categories (heifers, steers, male bovines) rose slightly in August compared to July—suggesting tighter supply or rising cost pressures.

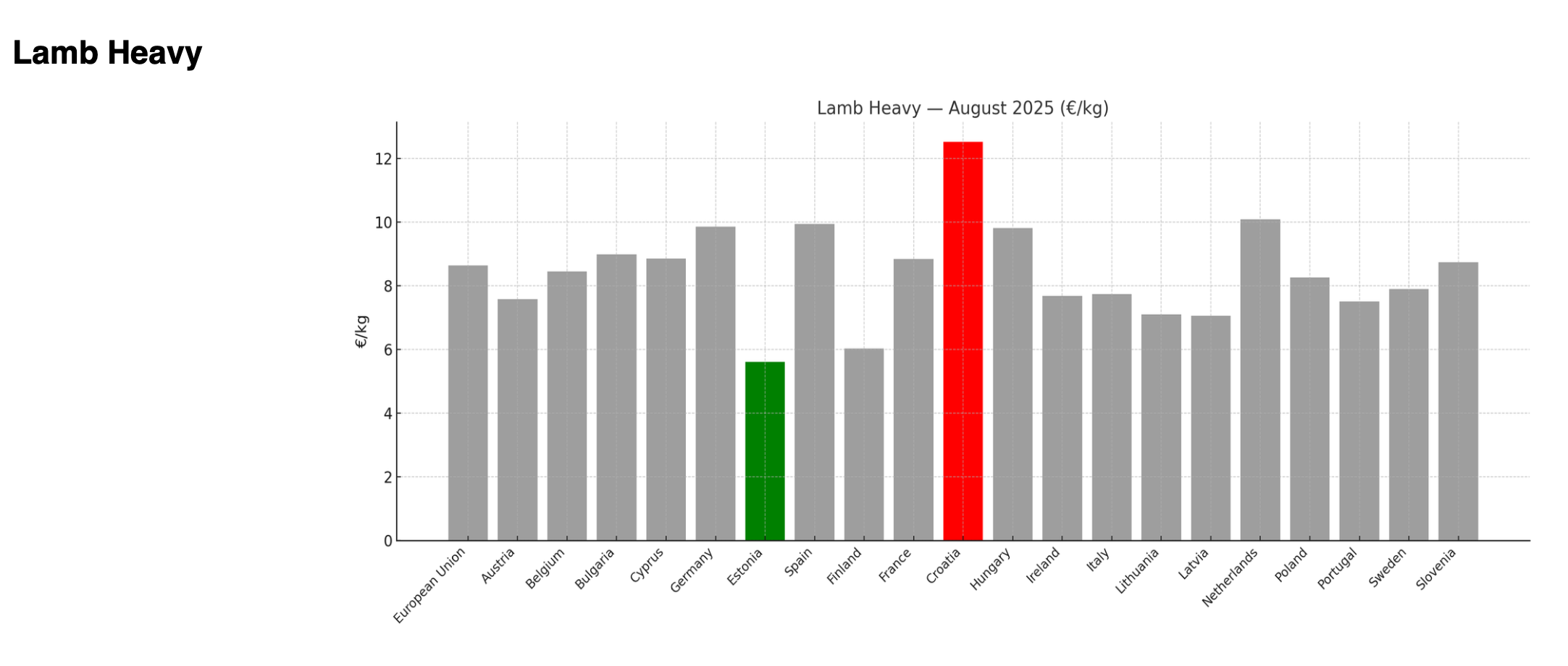

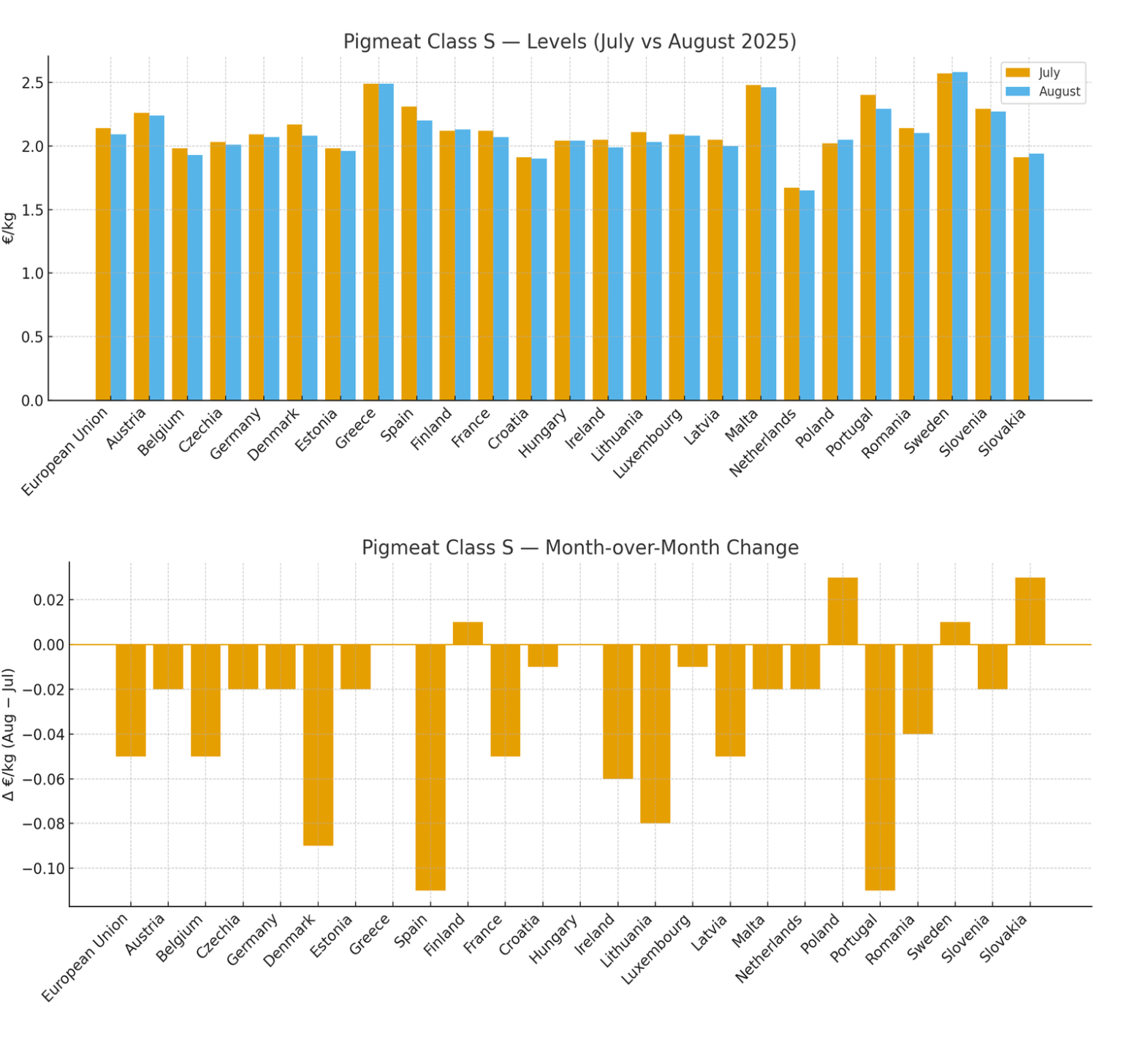

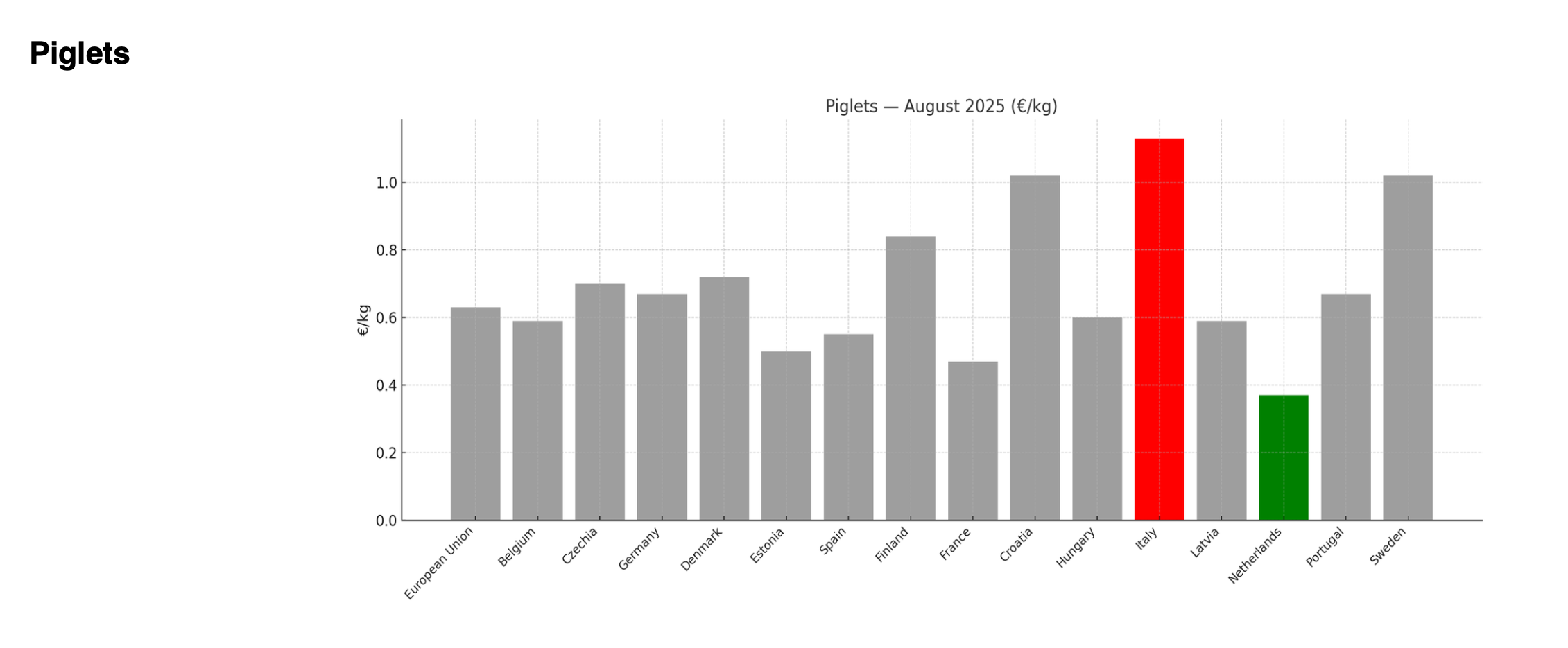

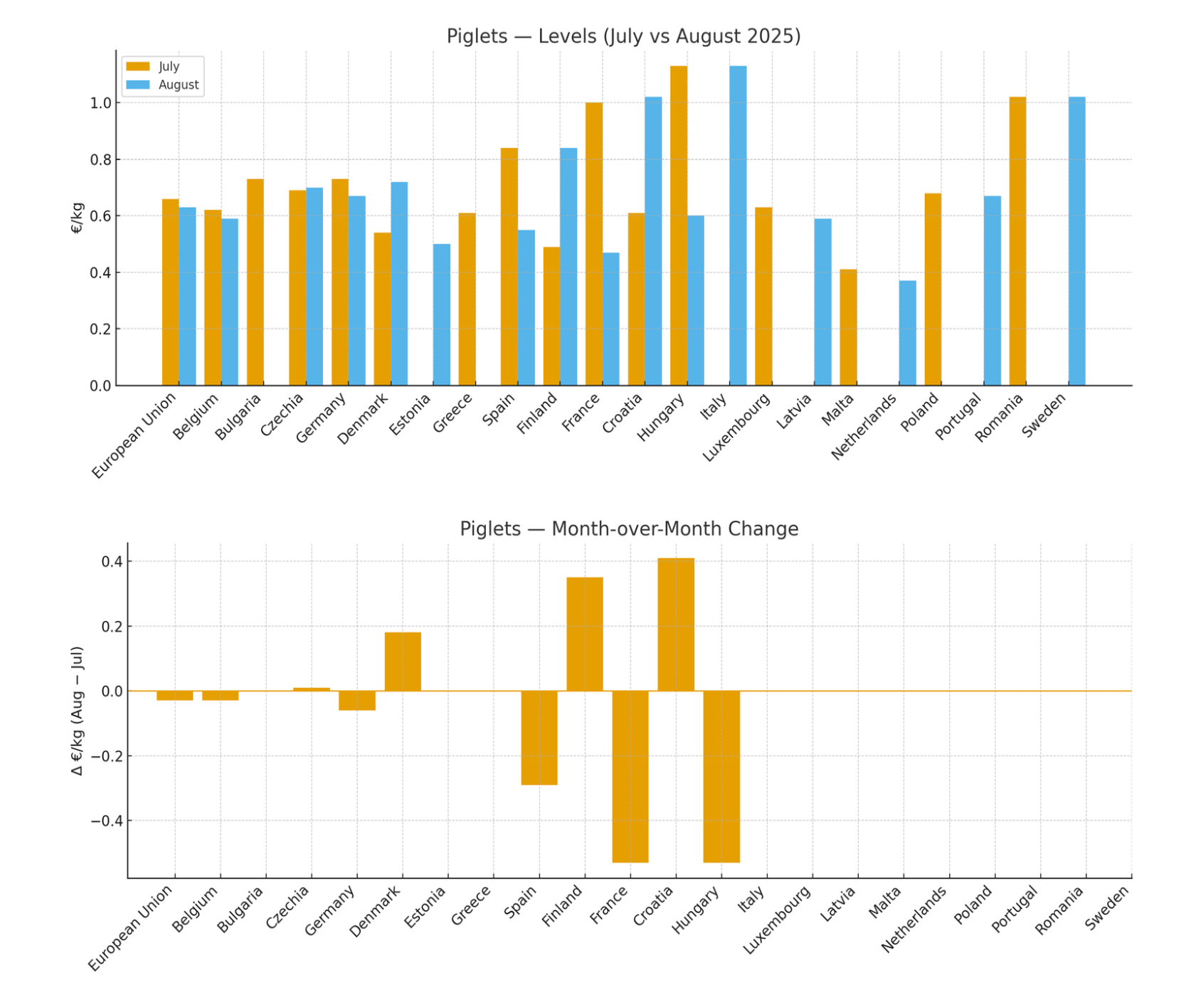

For lamb (both heavy and light) and piglets, there was a small drop or flattening in many countries—possibly due to seasonal effects or reduced demand.

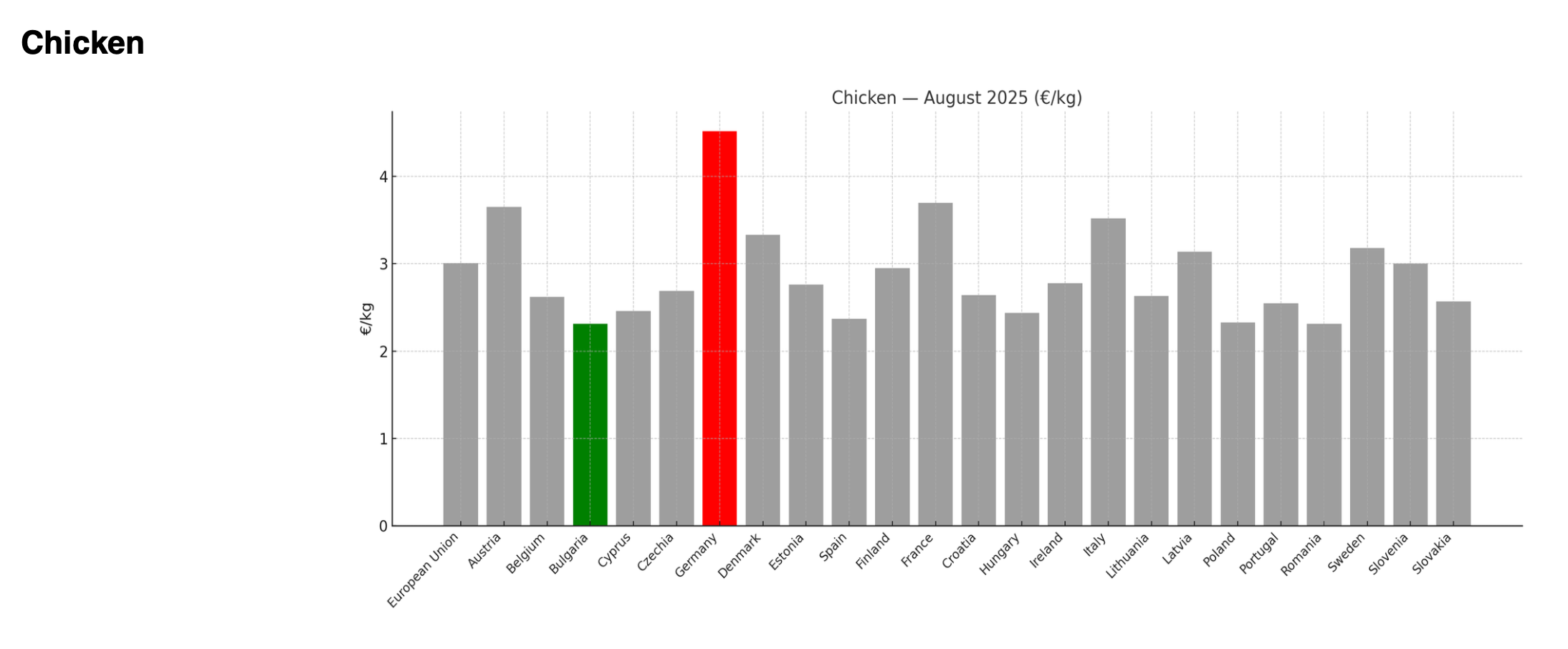

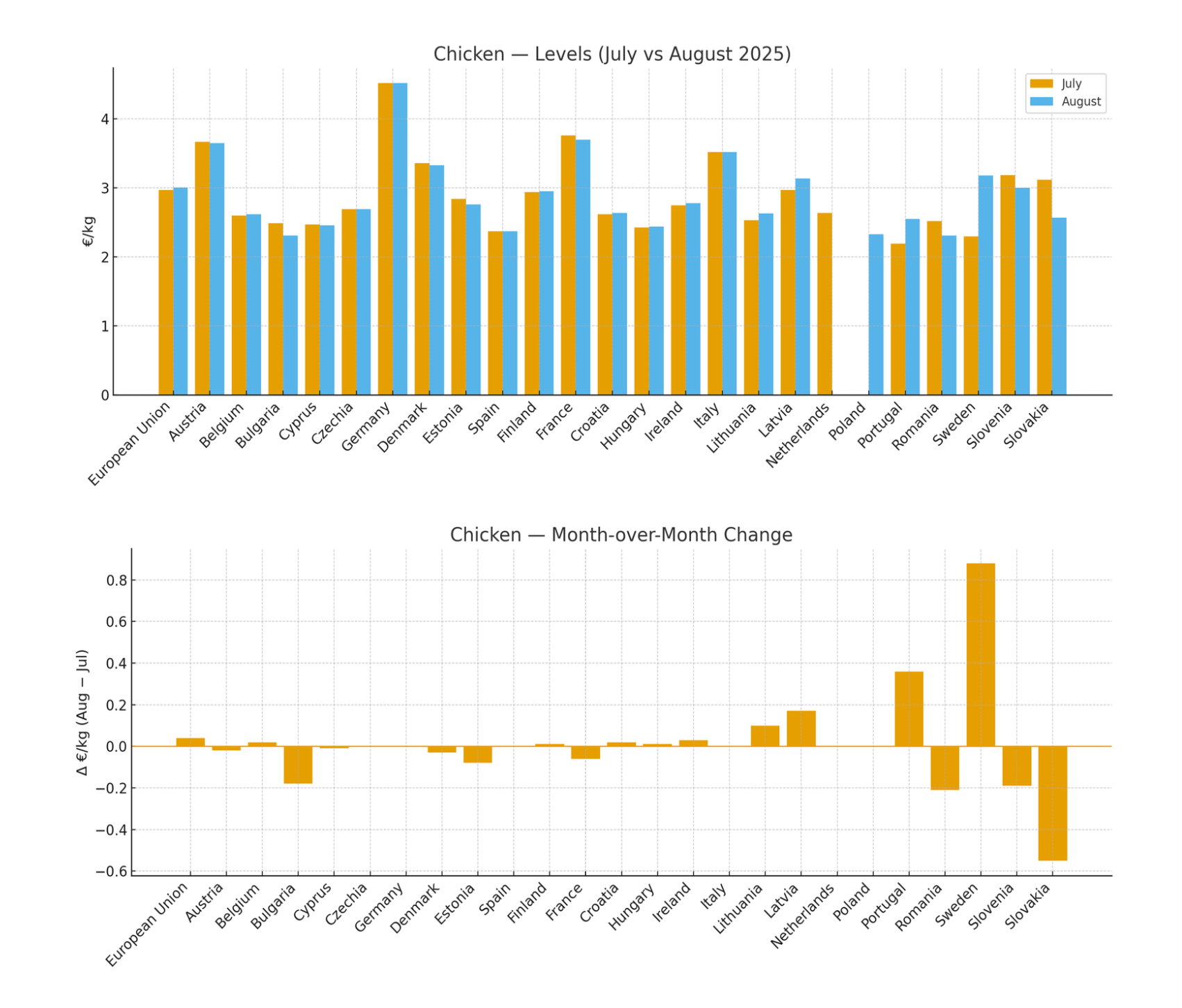

Chicken prices stayed fairly steady in many markets.

What Might Be Driving These Changes

Here are a few external influences that appear relevant:

According to the FAO, the global meat price index rose in August, led especially by beef and sheep meat.

Energy and feed costs are a major influence. For beef and cattle, feed grain costs and input costs remain high, especially when feed is imported.

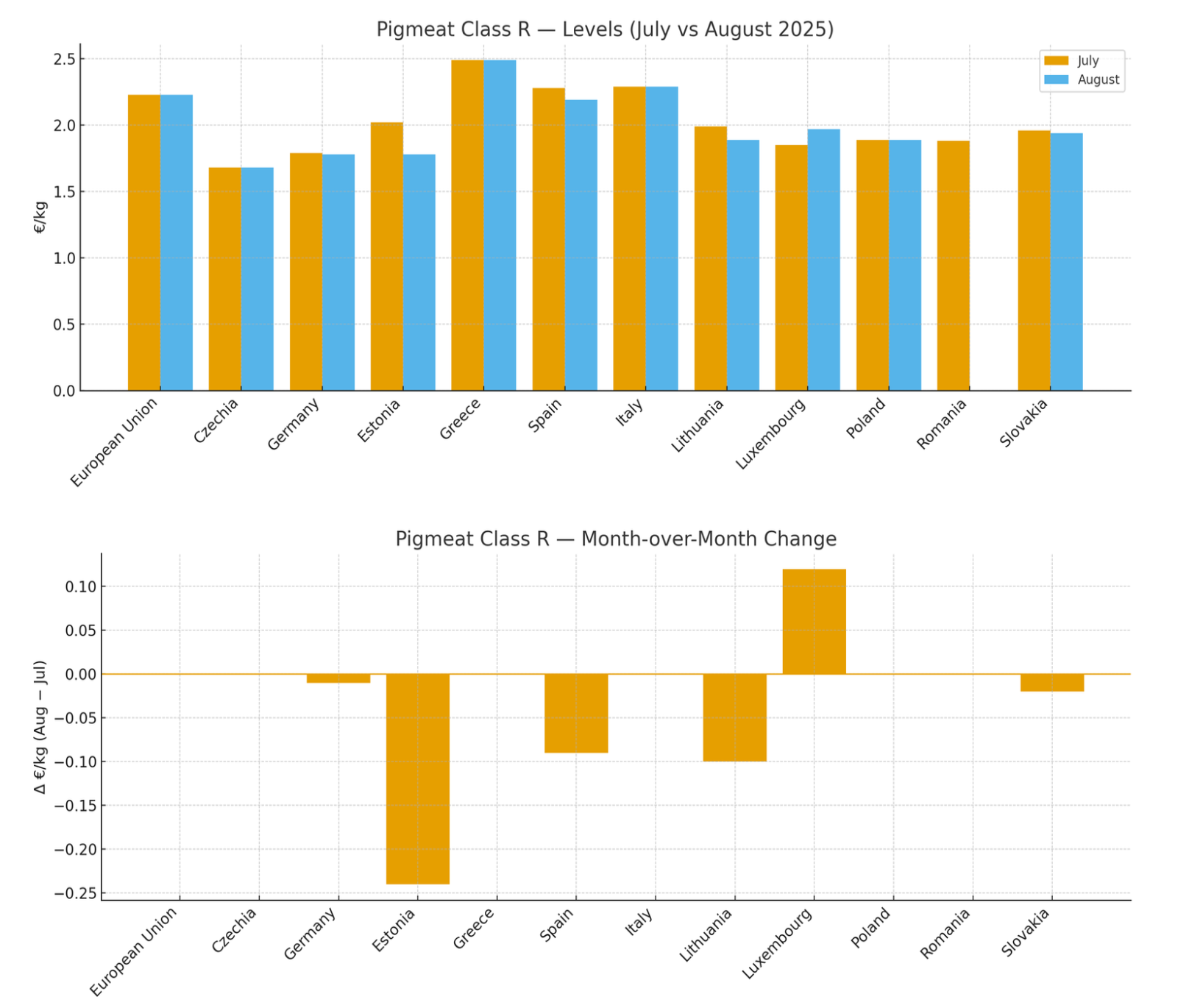

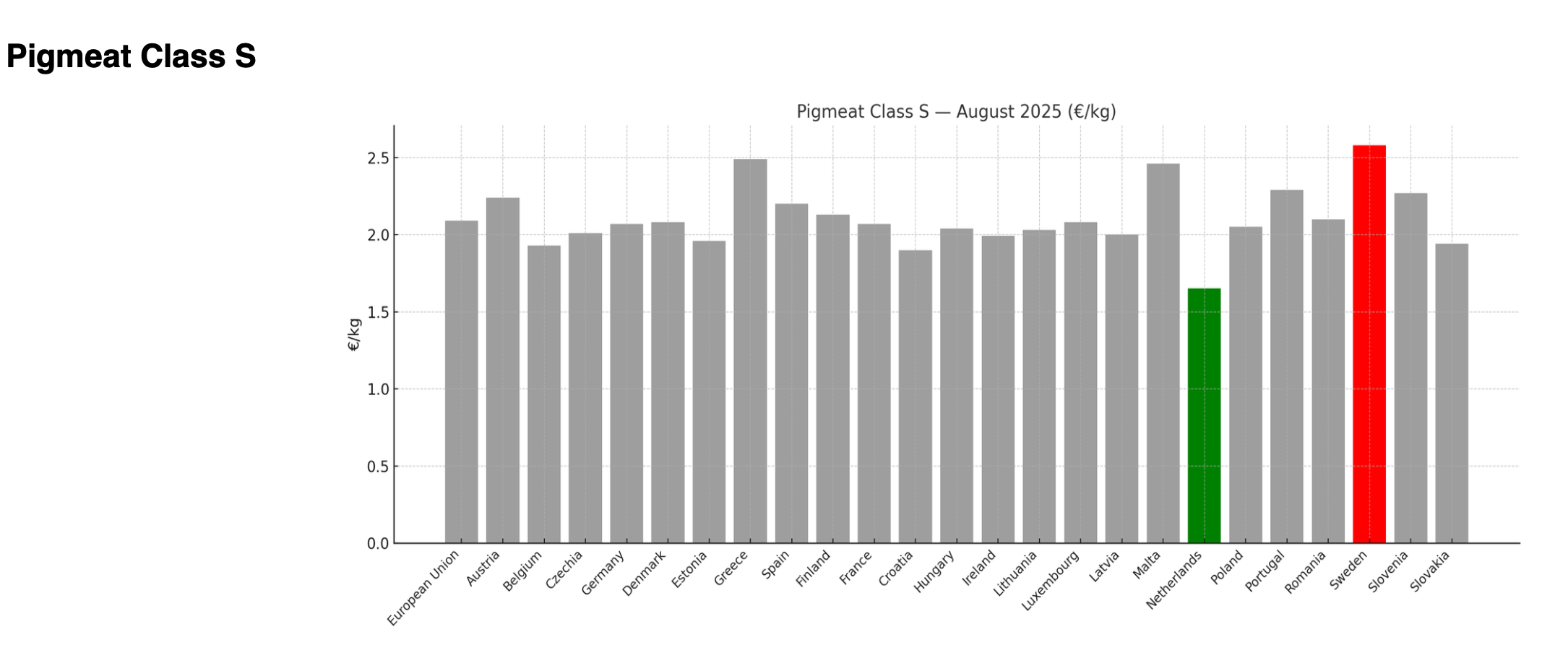

There is some weaker export competitiveness for EU pork in certain markets, and forecasts expect pork production to be stable or slightly down for the rest of the year.

Global demand from countries like China (for beef) and strong international beef prices are pushing up EU prices as well.

Simple Takeaway

Overall, August looks like a month where beef and cattle meat saw upward momentum, while some lamb and piglet prices softened. Chicken was more stable. If input costs (like feed, energy) stay high or demand stays strong, the upward pressure on beef is likely to continue.

Disclaimer: This report is for information only. Always check the official EU Commission data and factor in your own local costs before making business decisions.

All meat prices per country:

Price extremes:

Prices per animal category:

EU Average & trends:

Sources:

https://agridata.ec.europa.eu/extensions/DashboardPrice/DashboardMarketPrices.html

FAO — Global Meat Price Index, August 2025 update:

https://www.fao.org/newsroom/detail/fao-food-price-index-is-virtually-unchanged-in-august/enEuroMeatNews — QMS snapshot of the red meat market, Summer 2025:

https://euromeatnews.com/Article-QMS%3A-Snapshot-of-the-red-meat-market-in-summer-2025/8787EuroMeatNews — AHDB: EU short-term outlook for red meat production, 2025:

https://euromeatnews.com/Article-AHDB%3A-EU-short-term-outlook-predicts-red-meat-production-declines/8749Ceva Ruminants — Beef market outlook, August 2025:

https://ruminants.ceva.com/news/beef-market-outlook-august/