EU Meat Prices – October 2025

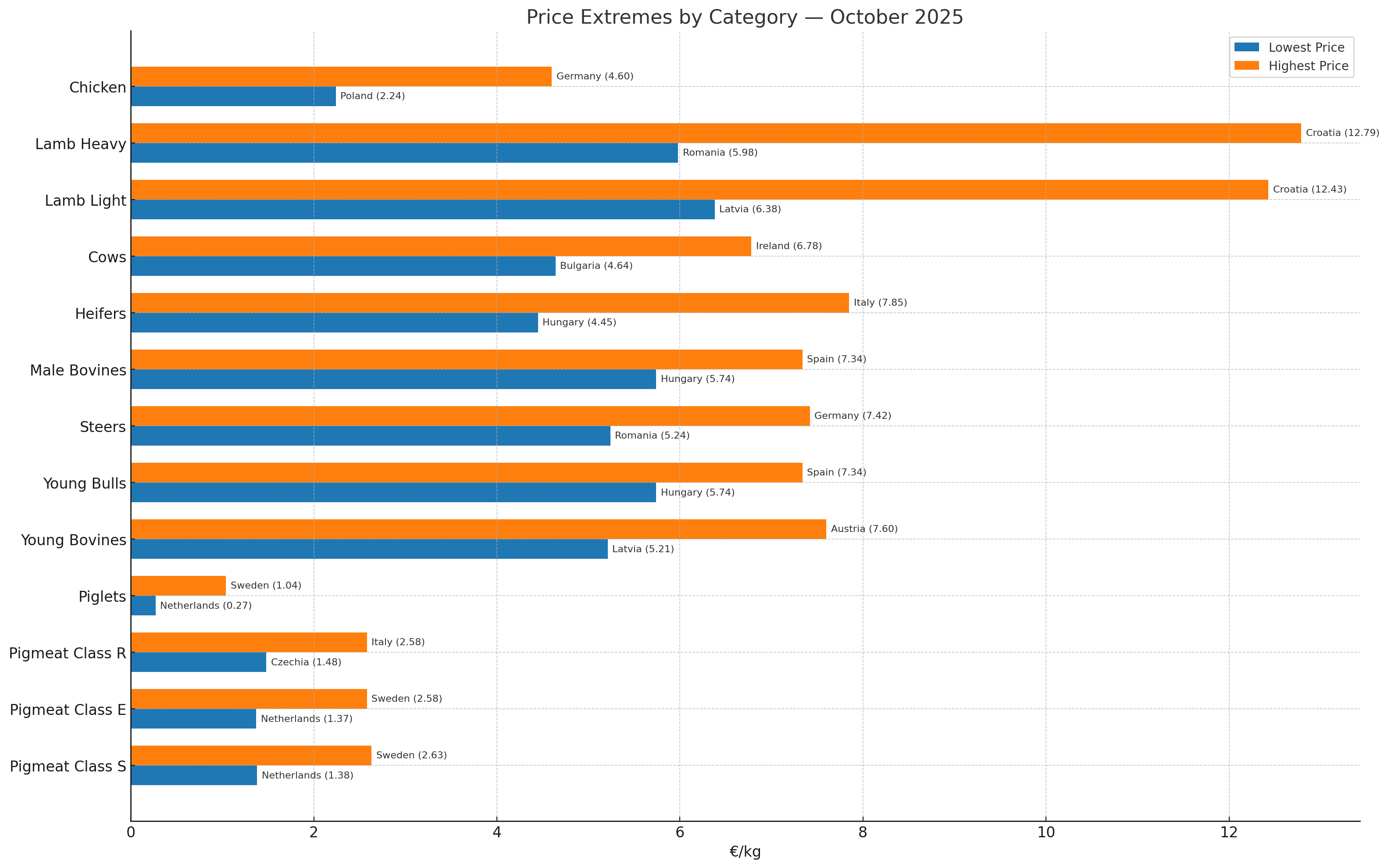

Cheapest & Most Expensive EU Countries by Animal Type

Using the latest European Commission price data for October 2025, we look at how meat prices compare across EU member states by species and product class.

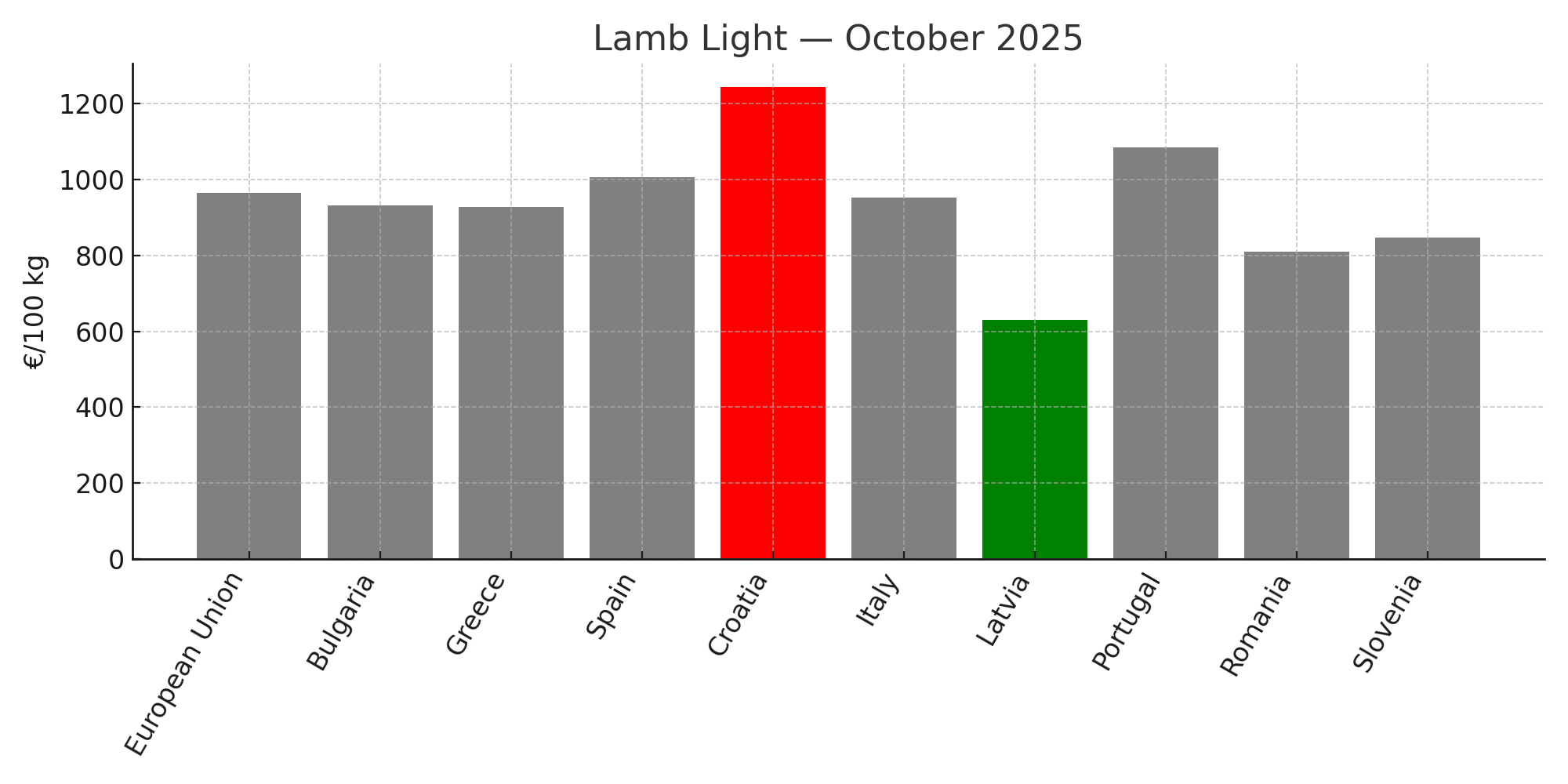

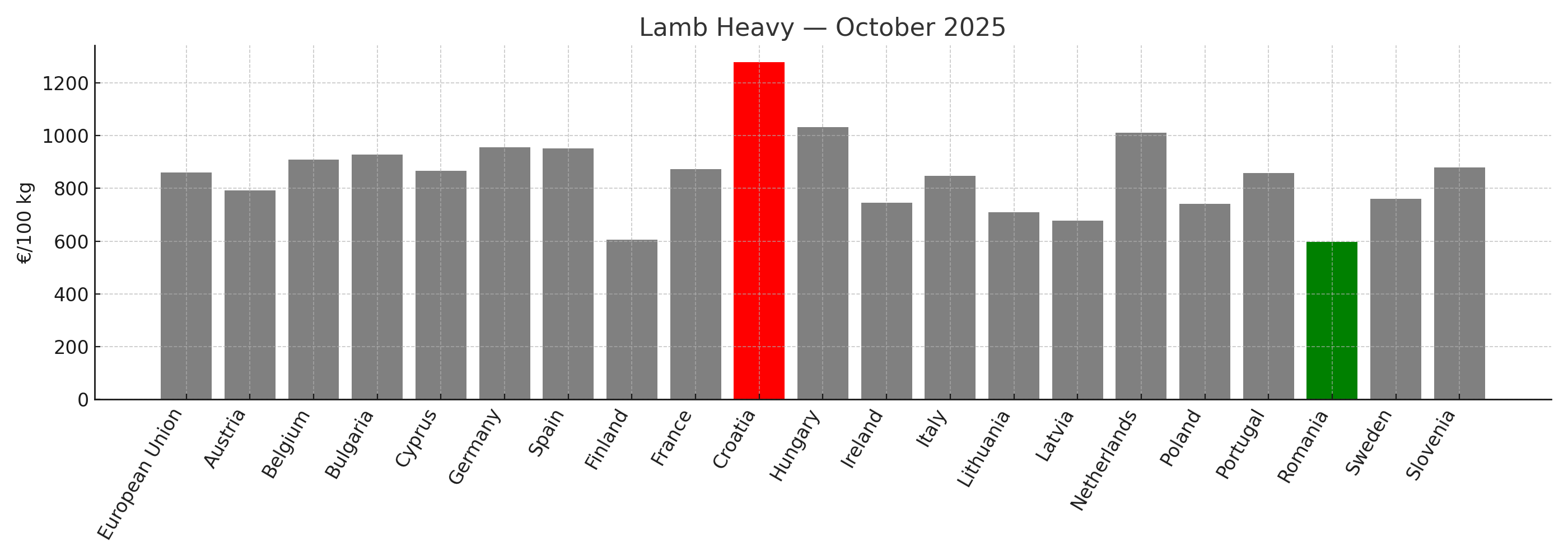

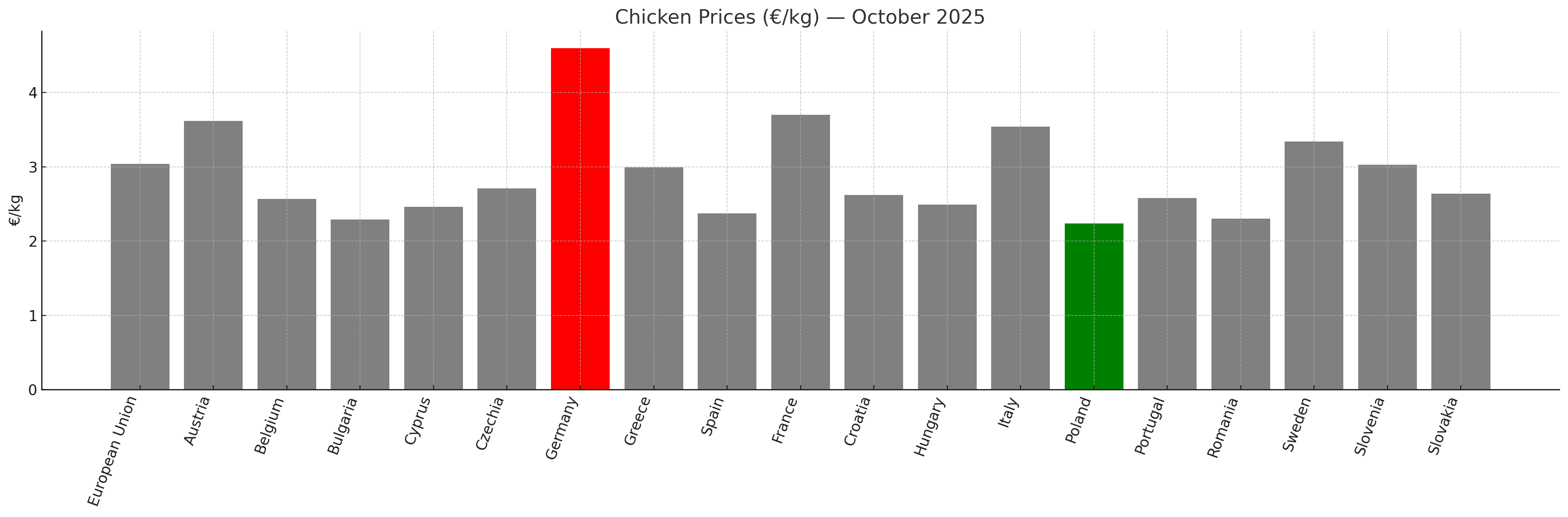

All prices in the underlying tables are expressed in €/100 kg carcass weight.

In the commentary below, we convert them to €/kg (simply dividing by 100) to make cross-country comparisons easier to read.

As in previous months, the differences between member states are striking: for some products, the most expensive market is more than double the cheapest.

Methodology & data

Source: European Commission, official monthly price reporting by Member States.

Coverage: All EU countries for which price data were available in October 2025, plus the EU average.

Products covered:

Pigmeat: Classes S, E, R + piglets

Beef: young bovines, young bulls, steers, male bovines, heifers, cows

Sheep & goat meat: light lamb, heavy lamb

Poultry: chicken

Units:

Source data: €/100 kg carcass weight

In the text: €/kg, rounded to two decimals

In the tables/graphics:

The cheapest country each month is marked in green

The most expensive is marked in red

Units: €/100 kg carcass weight

Price extremes:

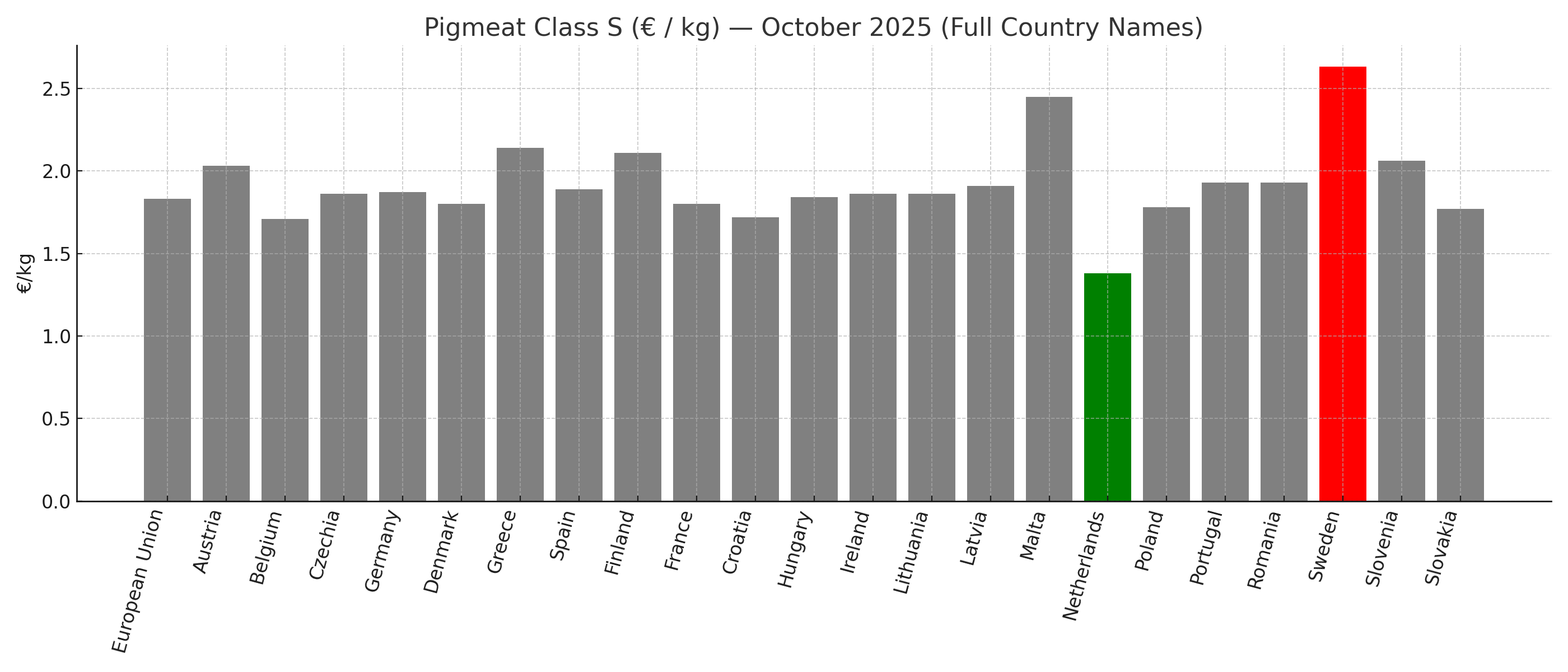

1. Pigmeat: EU averages stable, but very wide range between NL and SE

1.1 Pigmeat Class S

EU average: €1.83/kg

Cheapest: Netherlands – €1.38/kg

Most expensive: Sweden – €2.63/kg

In October, pig carcass prices in Class S remain relatively moderate at EU level. The Netherlands sits firmly at the low-cost end, while Sweden is almost €1/kg above Dutch prices, underlining its status as a high-price market for premium pigmeat.

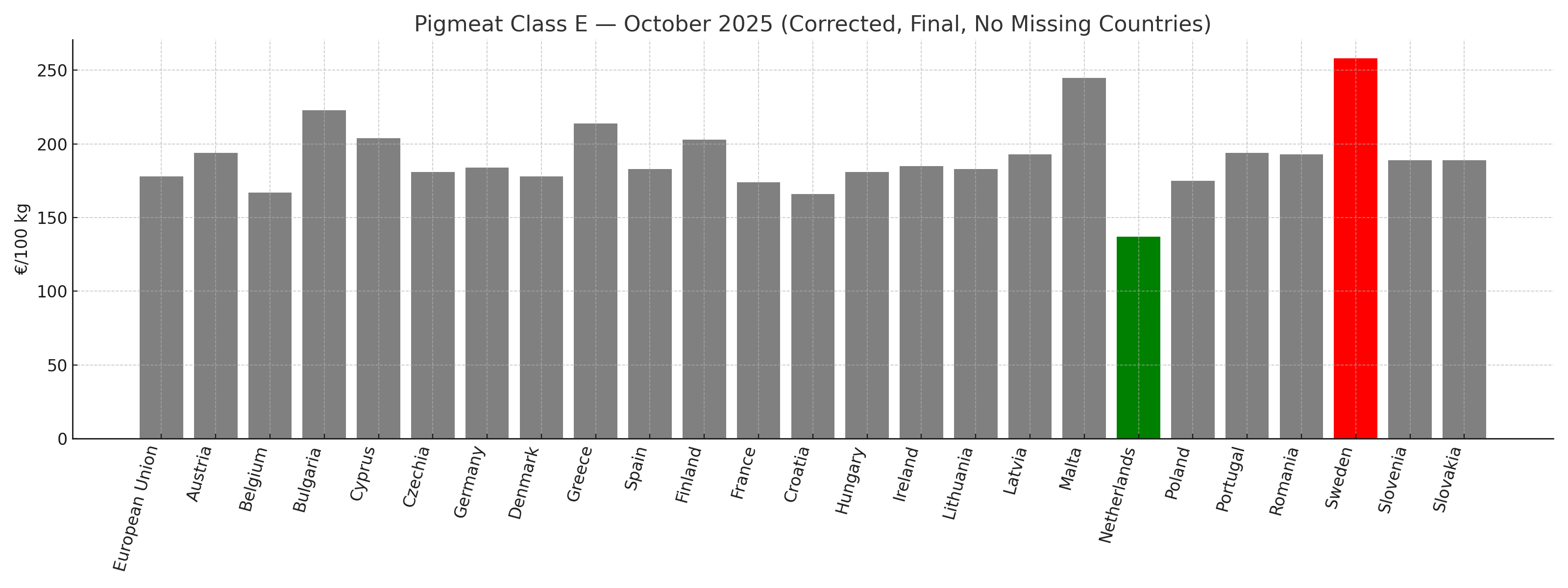

1.2 Pigmeat Class E

EU average: €1.78/kg

Cheapest: Netherlands – €1.37/kg

Most expensive: Sweden – €2.58/kg

The pattern is similar in Class E: the Netherlands remains clearly the cheapest origin, with Sweden again at the top of the range.

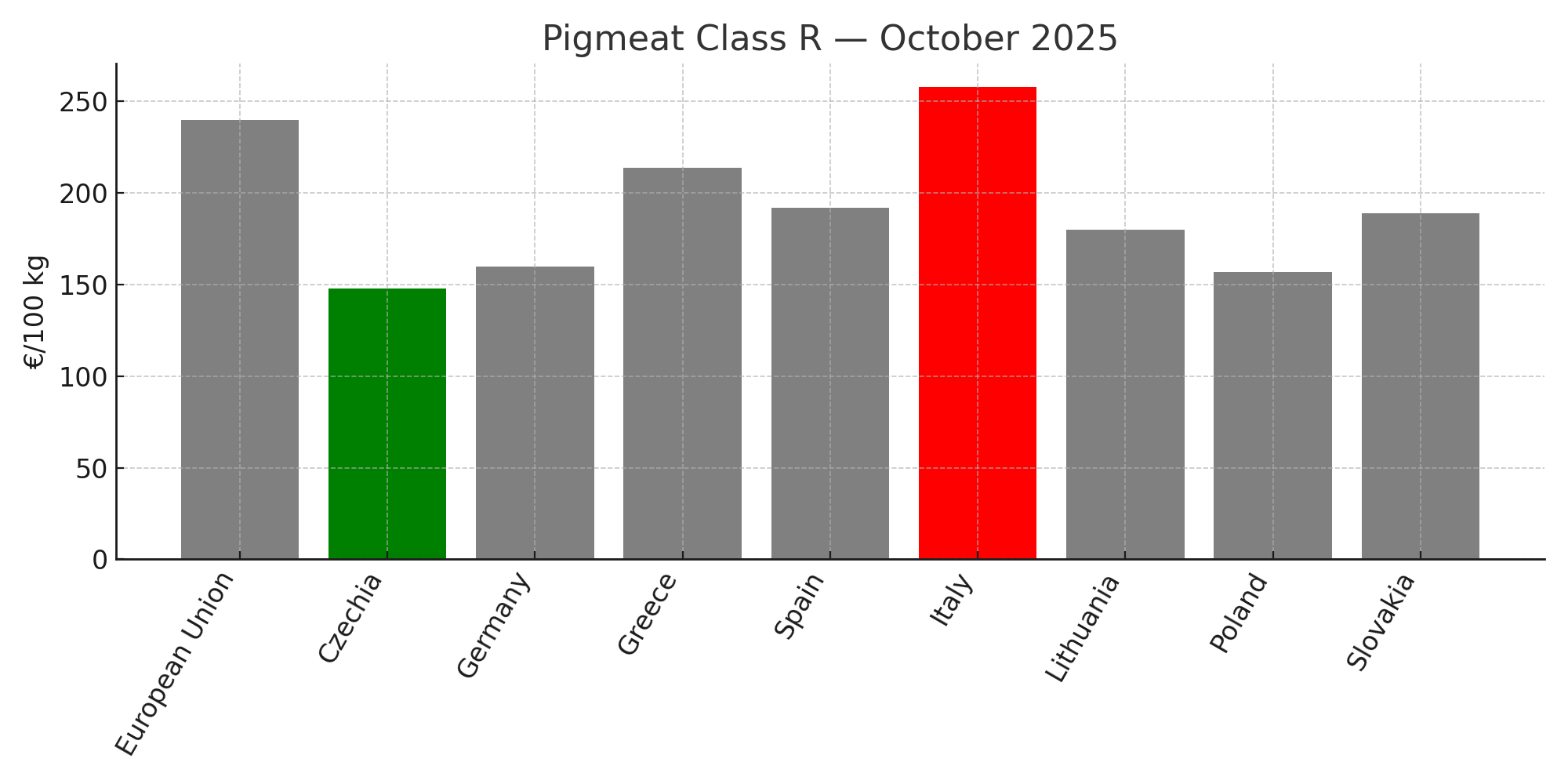

1.3 Pigmeat Class R

EU average: €2.40/kg

Cheapest: Czechia – €1.48/kg

Most expensive: Italy – €2.58/kg

For Class R, Czechia takes over as the lowest-price producer, while Italy records the highest average in October. This reinforces how southern, higher-cost markets often sit well above central European levels.

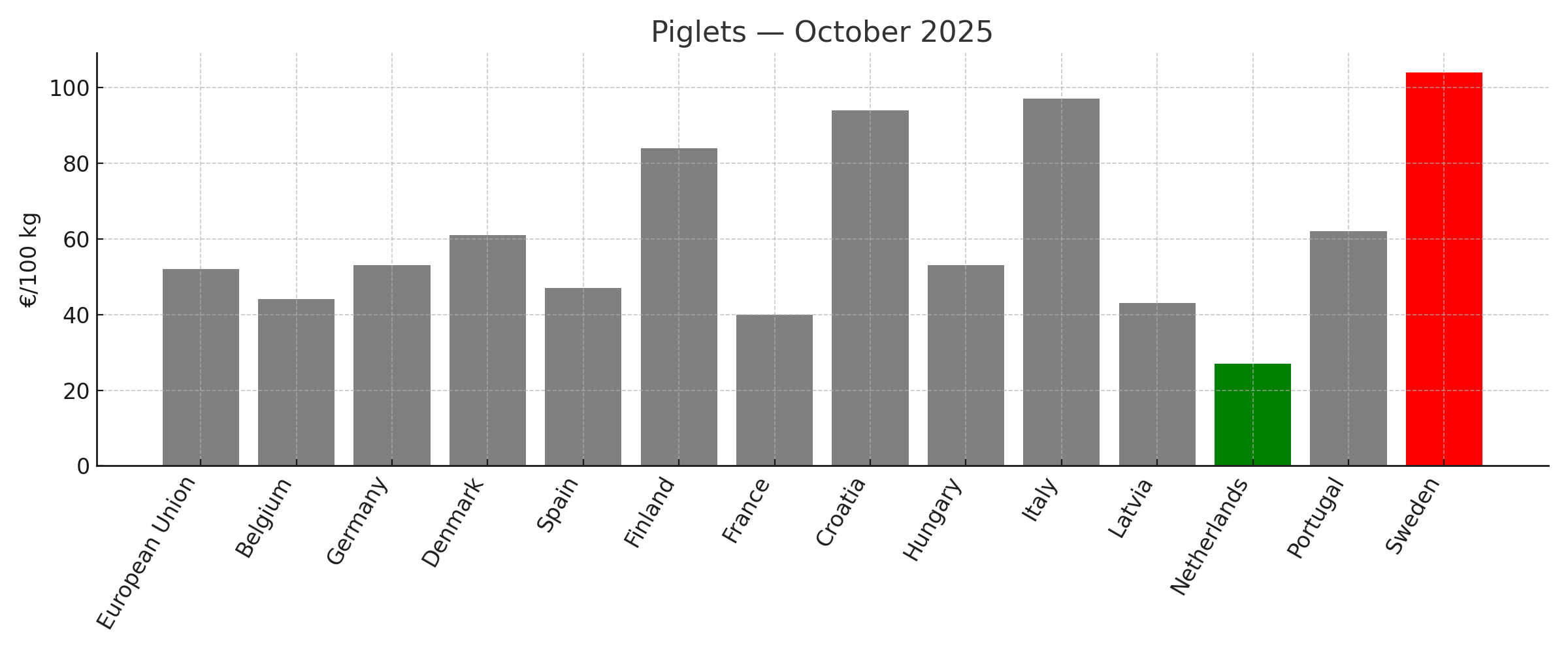

1.4 Piglets

EU average: €0.52/kg

Cheapest: Netherlands – €0.27/kg

Most expensive: Sweden – €1.04/kg

Piglet prices show extreme dispersion. Dutch piglets are priced at roughly one-quarter of Swedish levels.

2. Beef: firm autumn market, strong gaps between low-cost CEE and high-cost western states

Autumn typically brings steady beef demand, and the October data confirm firm prices across all categories. EU averages range from about €6.27/kg for cows to €7.27/kg for steers.

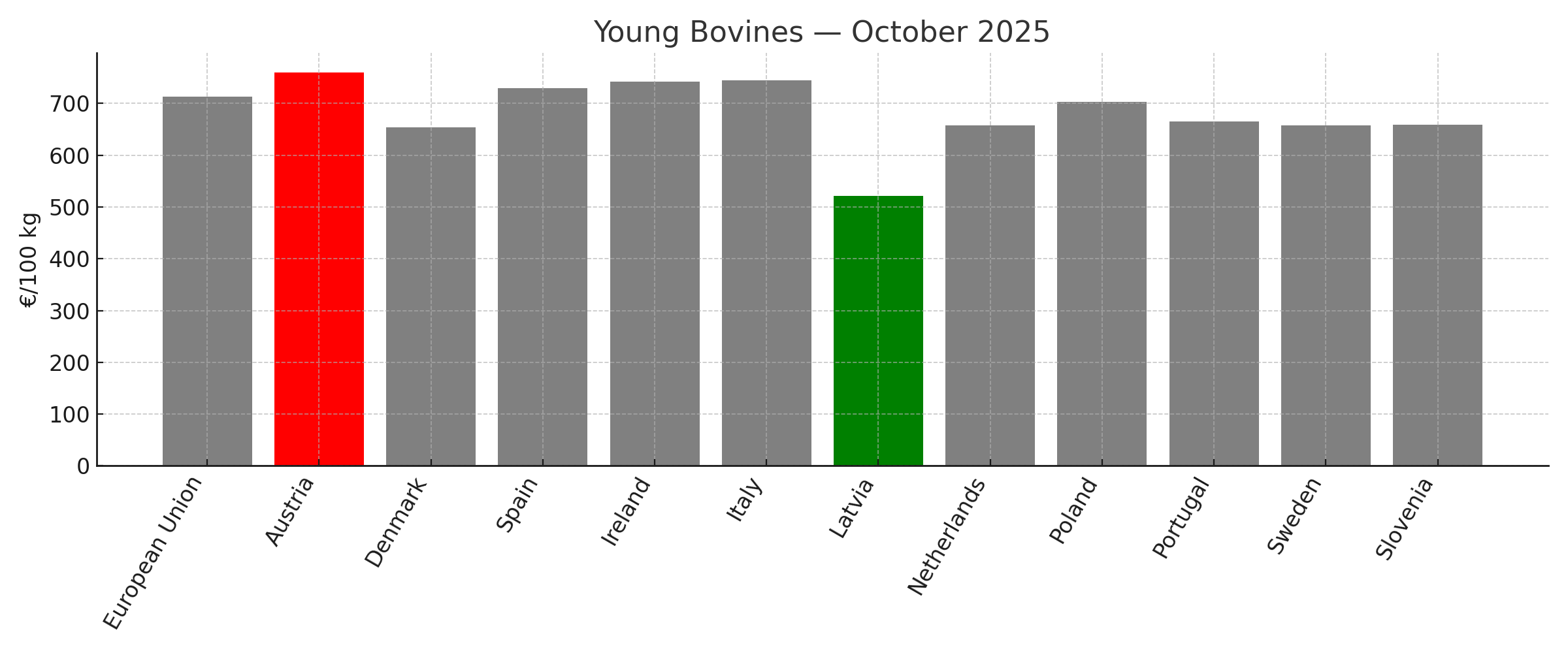

2.1 Young bovines

EU average: €7.13/kg

Cheapest: Latvia – €5.21/kg

Most expensive: Austria – €7.68/kg

Young bovine prices show a classic east–west split: Baltic producers offer some of the lowest-cost cattle, while Austria sits nearly €2.50/kg higher.

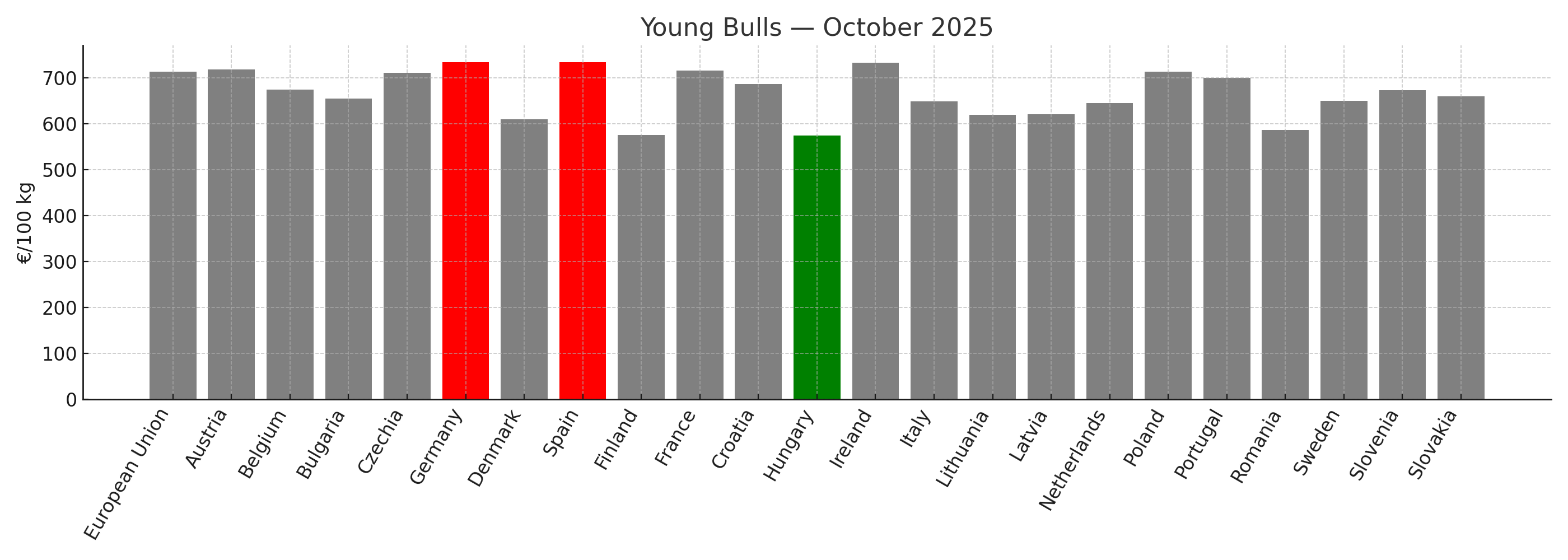

2.2 Young bulls

EU average: €7.13/kg

Cheapest: Hungary – €5.74/kg

Most expensive: Spain/Germany– €7.34/kg

Young bull prices remain tight but firm, with Hungary at the low end and Spain/Germany at the top.

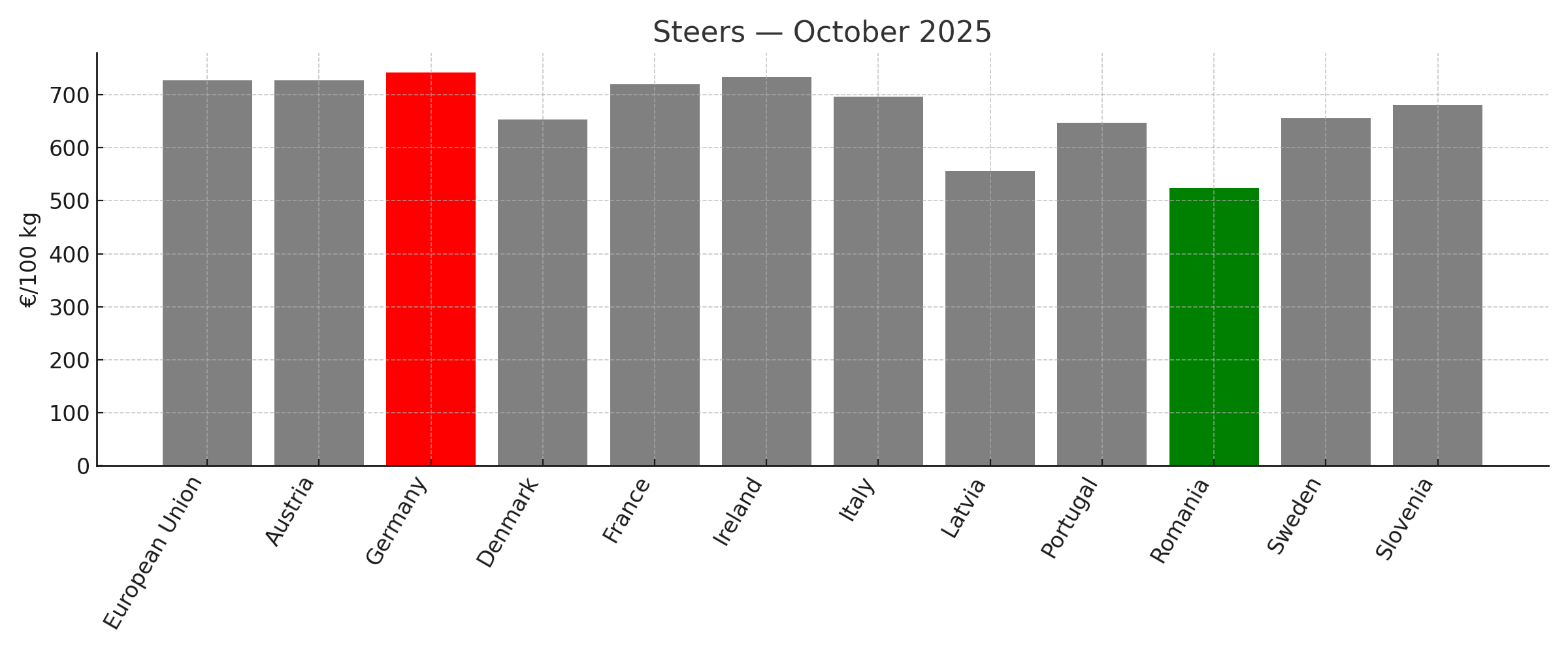

2.3 Steers

EU average: €7.27/kg

Cheapest: Romania – €5.24/kg

Most expensive: Germany – €7.42/kg

Steers remain the premium beef segment, with Germany at the top and Romania offering the lowest steer prices in the EU.

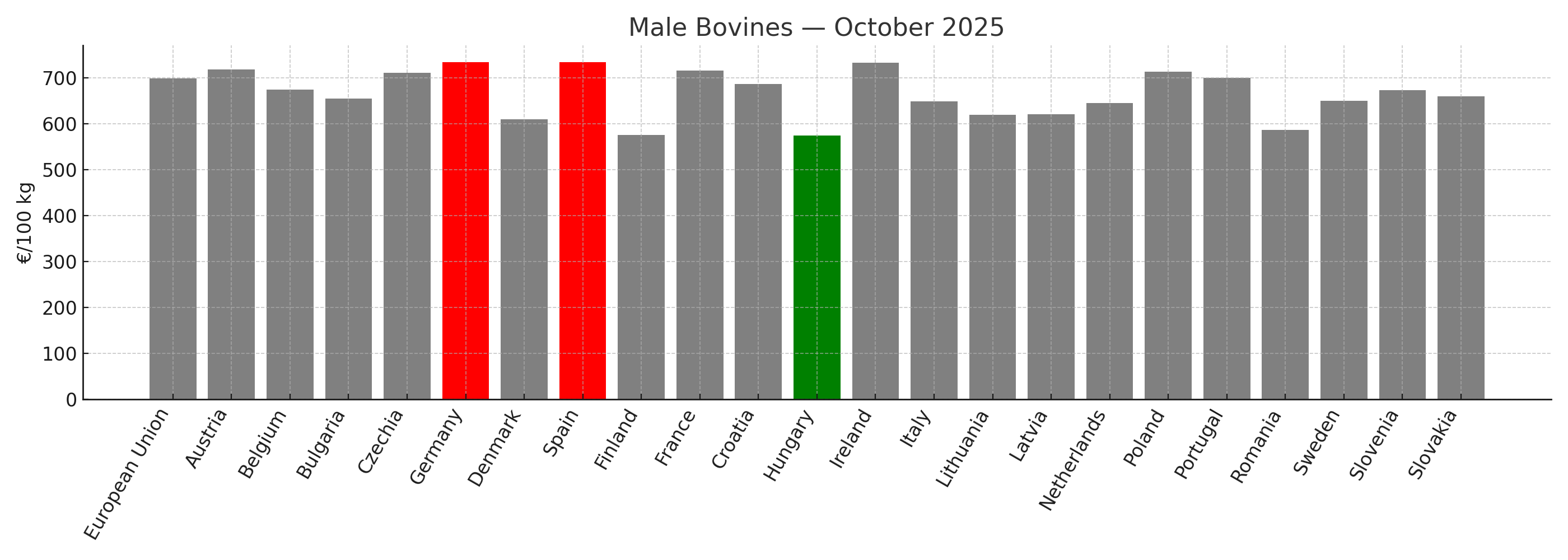

2.4 Male bovines

EU average: €6.98/kg

Cheapest: Hungary – €5.74/kg

Most expensive: Germany/Spain – €7.34/kg

As with young bulls, Hungary anchors the low end while Spain and germany leads the high end.

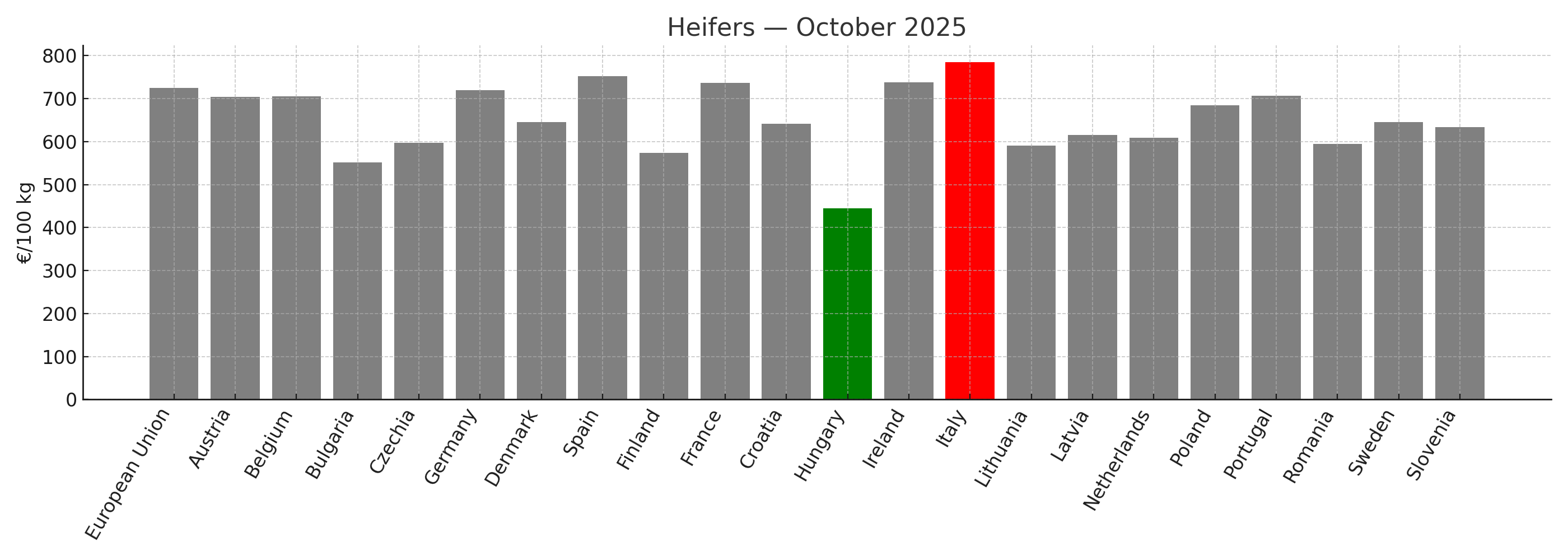

2.5 Heifers

EU average: €7.25/kg

Cheapest: Hungary – €4.45/kg

Most expensive: Italy – €7.85/kg

Heifers show one of the widest price spreads across the beef complex.

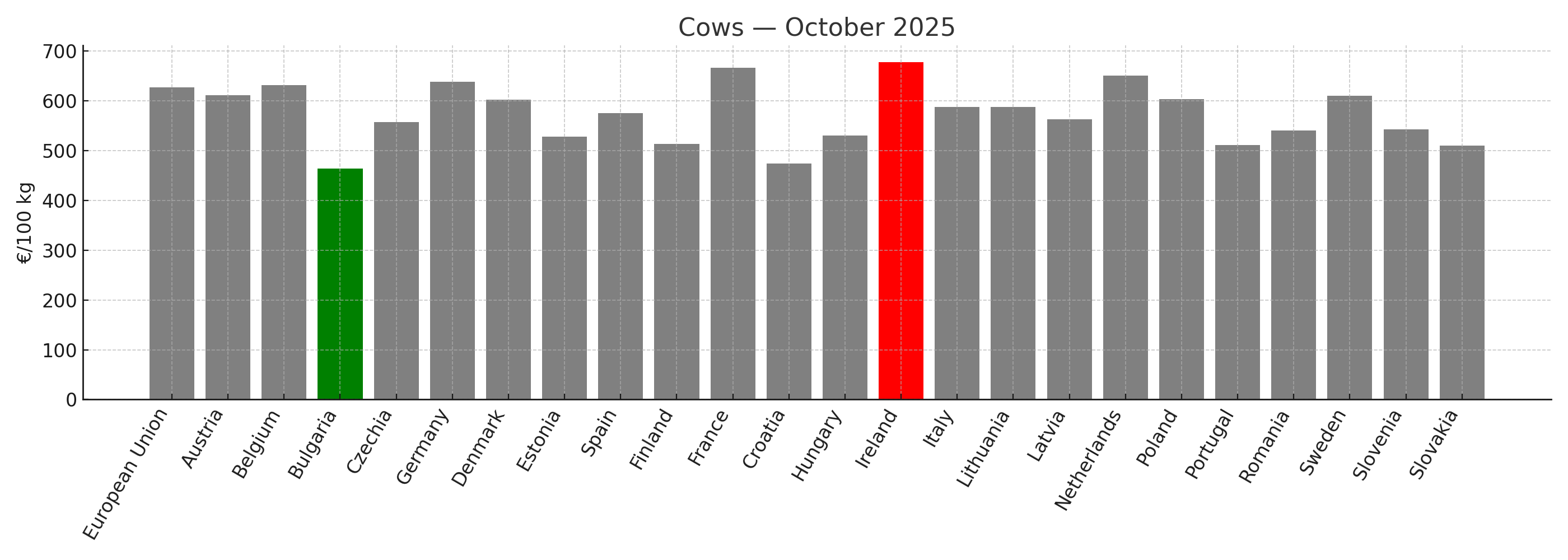

2.6 Cows

EU average: €6.27/kg

Cheapest: Bulgaria – €4.64/kg

Most expensive: Ireland – €6.78/kg

Cow prices are softer than young cattle but still historically firm.

3. Sheep & Goat Meat

Sheepmeat remains the most expensive red meat in the EU.

3.1 Light lamb

EU average: €9.64/kg

Cheapest: Latvia – €6.38/kg

Most expensive: Croatia – €12.43/kg

The spread is very large, from around €6 to over €12 per kilogram.

3.2 Heavy lamb

EU average: €8.61/kg

Cheapest: Romania – €5.98/kg

Most expensive: Croatia – €12.79/kg

The pattern mirrors light lamb, with extremely wide price variation.

4. Poultry: chicken still the cheapest meat, but Germany far above Poland

Chicken

EU average: €3.04/kg

Cheapest: Poland – €2.24/kg

Most expensive: Germany – €4.60/kg

Chicken remains the lowest-priced mainstream meat in the EU, but with notable internal price gaps.

5. What October 2025 tells us about the EU meat market

Sheepmeat is the standout high-price sector, with EU lamb averages between €8.6–9.6/kg.

Beef prices are firm across categories, especially in premium segments.

Pigmeat remains the volume workhorse, generally between €1.7–2.4/kg.

Chicken stays the cheapest major protein, though the Poland–Germany gap remains large.

The Netherlands consistently records the lowest pig and piglet prices.

Highest beef values typically appear in Italy, Ireland, Spain, Austria, and Germany.

Lowest beef values are most often found in Hungary, Romania, Bulgaria, and Latvia.

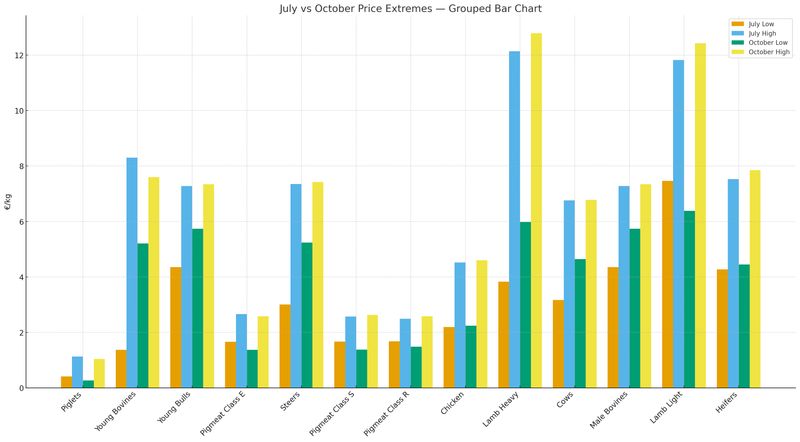

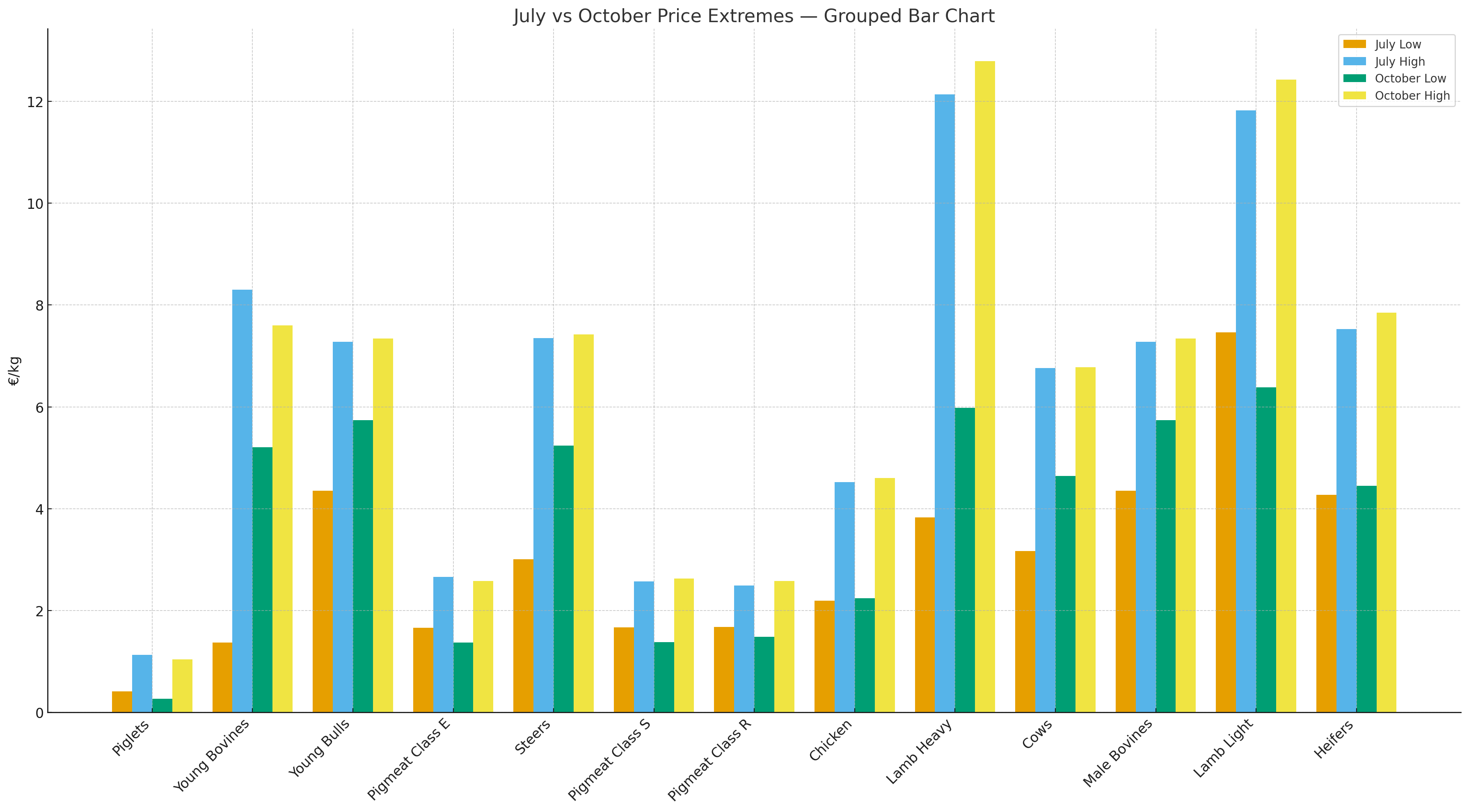

Meat price extremes: comparison between July 2025 and October 2025:

Across the EU meat market, the overall pattern of price extremes in October 2025 broadly mirrors what we saw in July, but several categories show a noticeable widening of the gap between the cheapest and most expensive origins. Pigmeat remains the most stable group: the Netherlands consistently provides the lowest prices, and Sweden stays at the top end for Classes S and E. Only Class R shifts, with Italy overtaking Greece as the highest-price market, and piglets also see a change as Italy replaces Sweden at the peak.

In beef, the picture becomes more dynamic. While the usual low-cost suppliers (Hungary, Latvia, Romania, Bulgaria) remain near the bottom of the distribution, the premium end moves around more than it did in July. October shows Germany, Italy, Spain, and Austria appearing as the most expensive markets depending on the cut, replacing earlier July highs from Luxembourg and Ireland. This creates a sense of greater price dispersion within beef segments compared to midsummer.

The sheepmeat sector stands out the most. In both July and October, Croatia is by far the most expensive producer for light and heavy lamb, but the gap widens even further by October. The cheapest origins (Latvia for light lamb and Romania for heavy lamb) stay the same as in July, yet Croatia’s premium becomes even more extreme, solidifying its position as the EU’s outlier in lamb pricing.

Finally, chicken remains the most stable and predictable category: Poland stays the cheapest and Germany the most expensive in both months. Although the ranking doesn’t change, the gap between them grows slightly in October, reflecting firmer high-end poultry markets.

Overall, July to October reveals a market where price rankings are broadly stable, but price spreads grow, especially in lamb and certain beef categories. The EU’s low-cost suppliers stay low-cost, but high-priced markets shift around more — and in some cases move even higher — through early autumn.

Source: https://agridata.ec.europa.eu/extensions/DashboardPrice/DashboardMarketPrices.html